Market Insights: Small Rays of Sunshine Amid Slower Economic Growth

Industry News | Logistics | Transportation | carriers | Freight Management | Shippers | Freight Broker

It's back-to-school season! If you see parents happy dancing after the school bus pulls away, congratulate them on their first moments of alone time in months. Other US families are finalizing their hunt for school supplies, clothes, and the latest tech gadgets.

Despite reports that economic growth is slowing, back-to-school spending is expected to reach a new high as parents prioritize mental wellness and sustainable options for their children. Those purchasing decisions are likely to increase spending by an average of 8% - 22%.

While some sectors might experience gains in the year's second half, others will report drawbacks. The home furnishings sector, which saw record sales while people stayed closer to home during the pandemic, is slowly losing its retail presence. With new home builds declining, US consumers prioritizing services over goods, and ongoing supply chain issues, the sector looks to be losing steam.

Also on our minds: gas prices. After hitting record highs in June, retail gas prices finally maintained a steady decline into early August, approaching an average price of $4 per gallon. The easement offset increases in the food, shelter, and electricity indexes. Diesel prices meanwhile remain high, seeing only slight declines. The US Energy Information Administration predicts that retail diesel prices will average $5.02 per gallon in 3Q22 and $4.39 per gallon in 4Q22.

Read on to see how current events are impacting rates and logistics. We've compiled data from multiple industry sources to help make sense of the markets.

Like what you're reading? Click Subscribe at the top of this post and receive weekly updates straight to your Inbox!

August Notables

- Spot rates continue to slide.

- Contract rates are starting to decrease but continue lagging spot rates.

- Diesel prices are declining, despite continuing to be high.

- Brake Safety Week is next week – expect a decrease in available capacity.

Looking to limit transportation disruptions? Connect with Armstrong for access to a network of more than 60,000 vetted, reliable North American carriers.

A Look at Rates

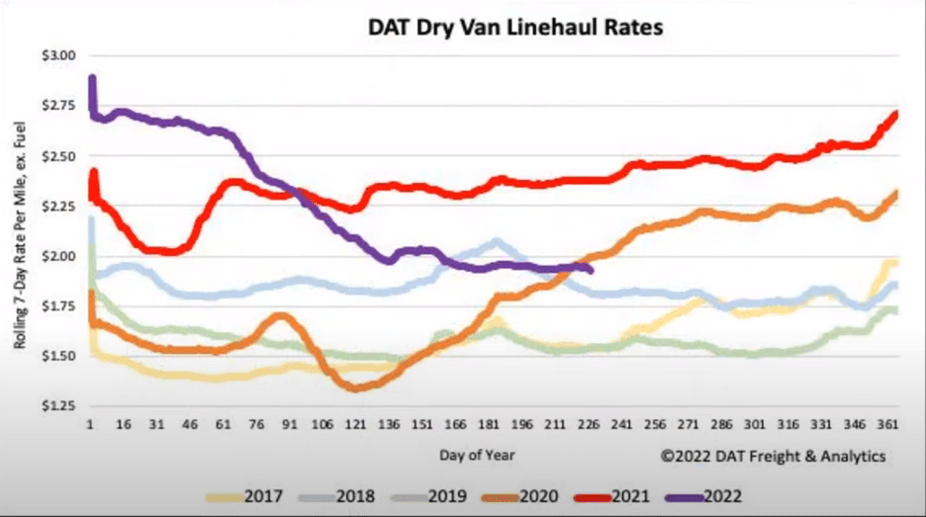

Dry Van

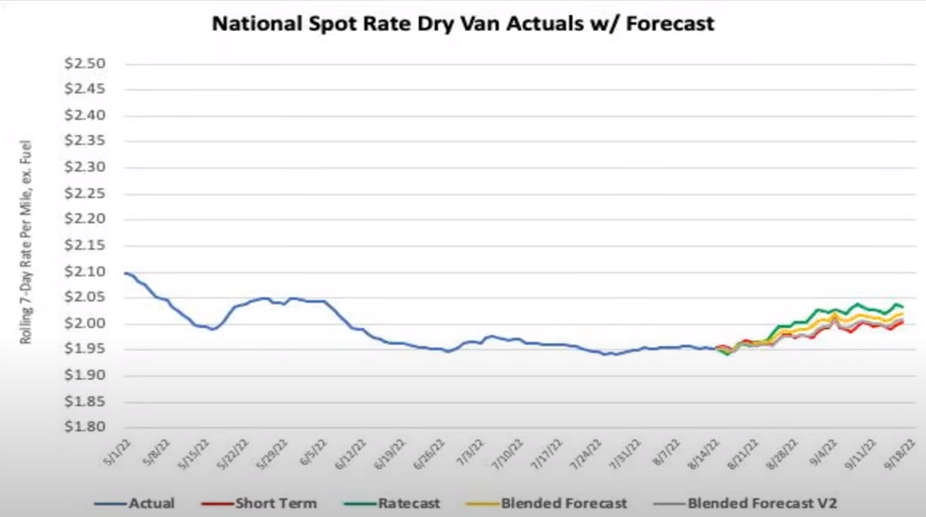

Dry van spot rates have continued their downward trend after remaining flat for just over a month. Load post volumes on DAT have decreased for three weeks, down 37 percent year over year. Dry van spot rates dropped $0.02 per mile over the last week and $0.45 per mile lower year over year.

Armstrong expects rates to hold flat through the month of August, increasing slowly in September through mid-October. Retail sales and holiday preparations are the primary drivers for the increase. Port cities should expect the most significant gains.

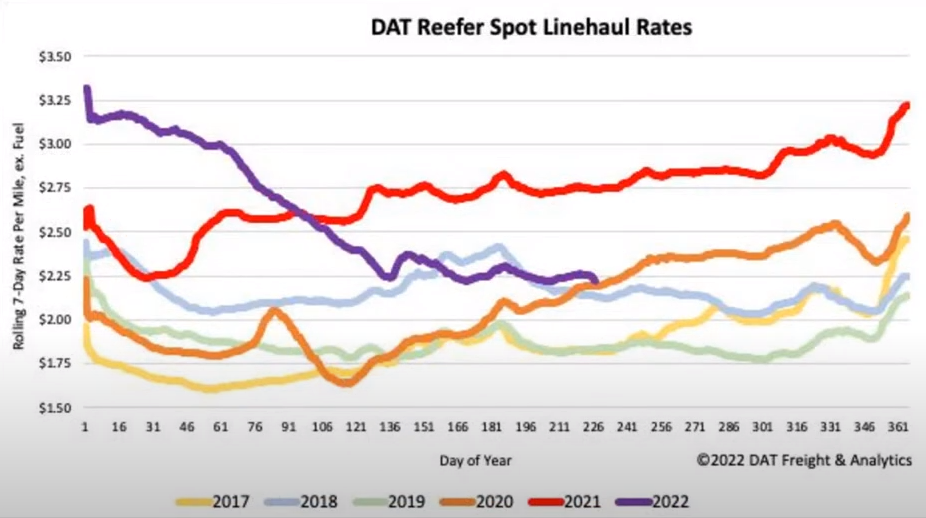

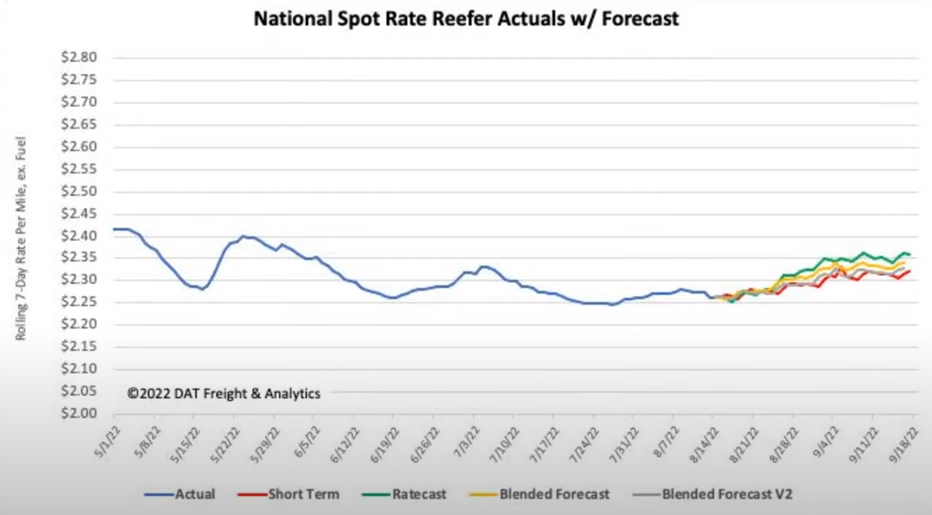

Reefer

Reefer rates have reverted to a downward trend after a month of ups and downs. Load post volumes are down about 46 percent compared to this time last year. Produce season is entering its peak period. Areas beginning their seasons now include Michigan, Idaho, Oregon, and Washington. Expect rates to jump in those areas but remain lower than last year. Washington State has predicted its crop will be down around 12 percent compared to last year due to a long and cold spring. Spot rates for reefers have dropped almost $1.00 per mile year-to-date and $0.52 per mile year over year.

Similar to dry van rates, we expect reefer rates to hold flat through the month of August and then increase slowly from September through mid-October. The main drivers for the increase will be produce levels peaking.

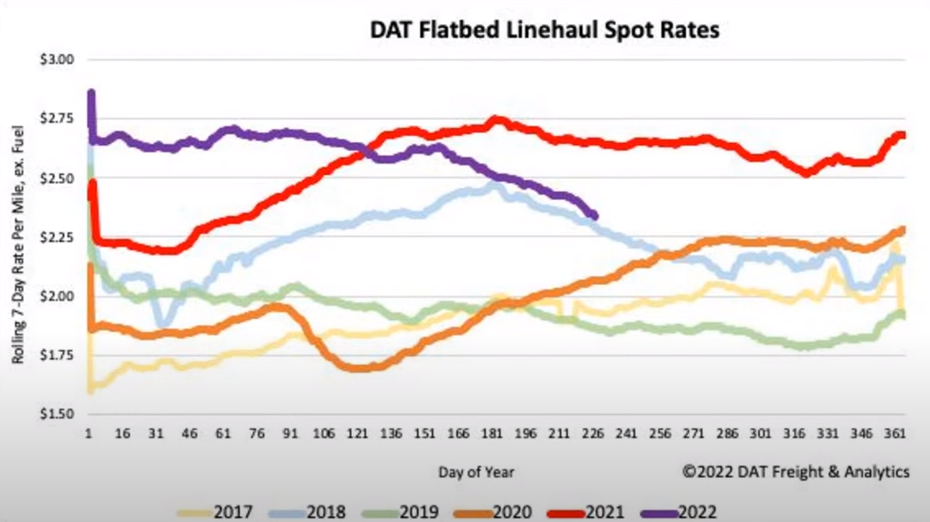

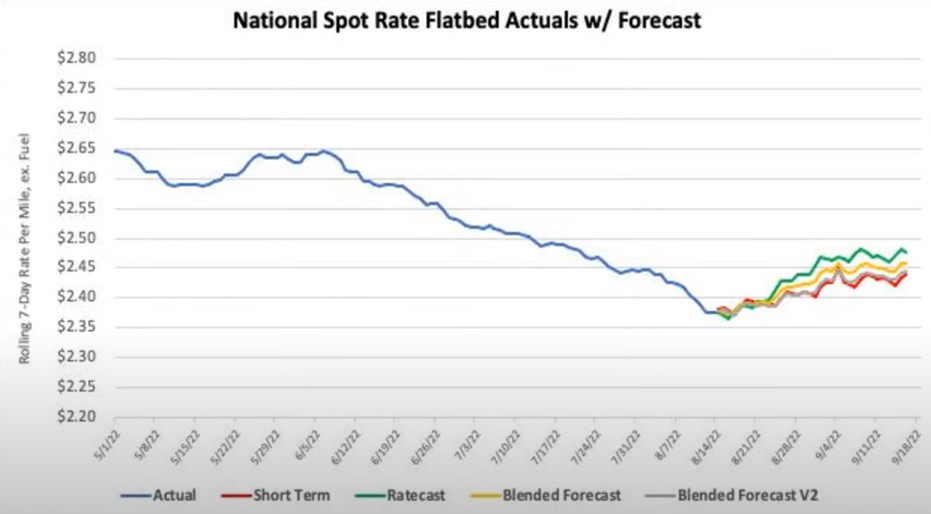

Flatbed

Flatbed spot rates have continued to drop for almost three months continuously. Flatbed load post volumes are down 51 percent compared to this time last year. Flatbed linehaul spot rates are down $0.32 per mile year over year and $0.12 per mile compared to last month. One of the leading causes of decreasing rates is the drop in building permits, down 4 percent month over month and 11 percent year over year.

Flat rates are forecasted to increase for the next month and a half. Armstrong does not expect rates to follow the predicted model primarily because the most significant driver of construction freight -- single-family homes -- is down 10 percent month over month and 17 percent year over year. The decrease accounts for nearly 200,000 fewer homes built in July 2022 compared to July 2021.

Imports

Import volumes continue to shift from the West Coast, providing respite for ports that have experienced unprecedented import volumes. Gulf Coast volumes are up 24% year over year, East Coast volumes are up 8% year over year, and West Coast volumes are down 7% year over year.

Rail

As reported in our July 2022 Market Insights post, President Biden commissioned a Presidential Emergency Board (PEB No. 250) to oversee railroad union negotiations. The current contracts with twelve US railway unions have expired. To avoid a costly union strike or railway lockout, President Biden took emergency action to help extend the existing agreements for 60 days, 30 remaining.

PEB No. 250 has made recommendations for both sides to settle; however, neither side has agreed on their position. In the event of a strike or lockout, Congress could pass back-to-work legislation forcing a no-strike or no-lock-out situation. Another possibility includes selective strikes where only some of the twelve unions may strike against specific rail lines.

Congress, which is under no obligation to act, is likely to weigh the impact of its actions ahead of November congressional elections. Industry watchers are concerned that political agendas could trump economic implications when the supply chain is already fragile and vulnerable to market changes. Armstrong will keep an eye on developments to better prepare and understand the potential nationwide impact on all modes of transportation.

Fuel

Diesel prices have continued a slow downward trend in the last two months. Fuel still accounts for over 30 percent of a truck's rate compared to linehaul, creating pressure for smaller carriers.

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)