Market Insights: Record Volumes Continue to Bolster Freight Rates Amid Tight Capacity

Industry News | Logistics | Transportation | carriers | Freight Management | Shippers | Freight Broker

Check back with us monthly to stay up to speed on freight market conditions. Our snapshots compile market data from public sources to help you stay informed.

This edition looks at how some things never change – at least not in 2021 – and how demand continues to outmatch capacity ahead of the notoriously tighter back-to-school and pre-holiday shopping seasons.

But first, a high-level recap of what’s happening in the market:

July Notables

-

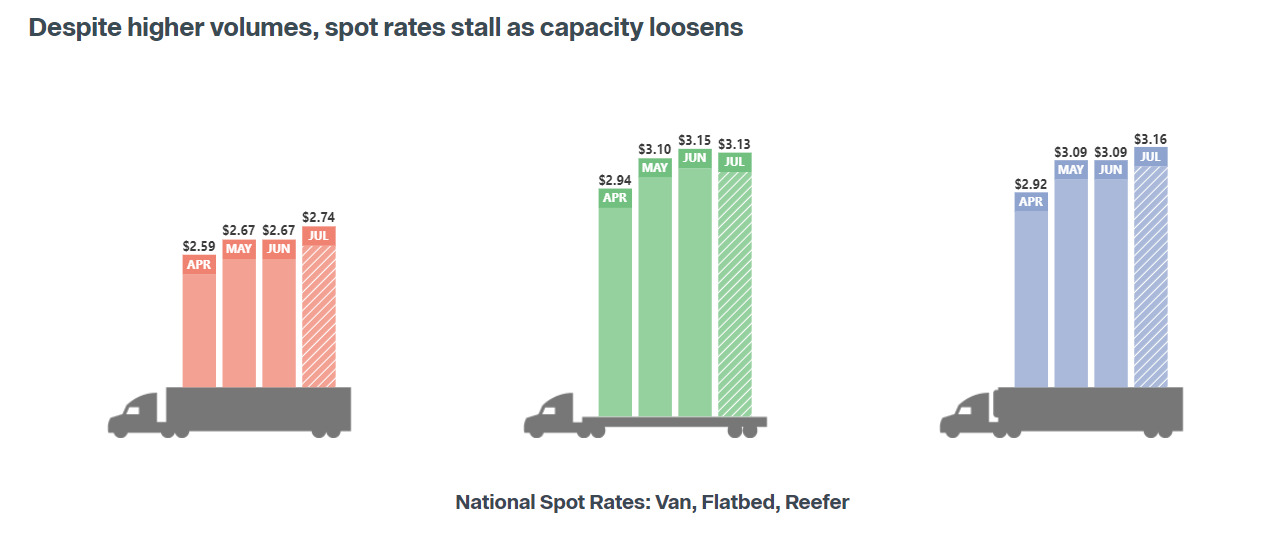

Capacity loosened as spot rates decreased on higher volumes.

-

Spot volumes increased by 12%.

-

Flatbed volumes jumped 21% week-over-week reversing a 10-week slide, and available equipment postings have increased 28% week-over-week.

-

Rates continue to hold around current levels even as capacity increases.

-

Of more than 400,000 power units ordered in the past 12 months, over half will be delayed until at least 2022 due to production issues.

Read on for additional insight into these numbers and current events!

Tight Capacity Continues

In cyclical markets like transportation and logistics you can always rely on a few constants – change being one. Another is that capacity rarely aligns with when it is needed.

While capacity loosened slightly in July, freight volumes are still high. There is simply too much demand to meet the number of available trucks and drivers. The industry is also grappling with ongoing port congestion where backlogs are creating lengthy delays for trucks waiting to pick up freight. Trucking companies rely on supply chain efficiencies to help increase their productivity, offsetting the costs of expensive trucks.

Why Not Add More Trucks?

The semiconductor supply chain is still experiencing issues. The ongoing shortage of computer chips, which are used liberally in all sorts of vehicles – including Class 5-8 trucks – to collect data is adding to the capacity crunch. Of more than 400,000 power units ordered in the past 12 months, over half will be delayed until at least 2022 due to production issues.

A Closer Look at Freight Rates and Volumes

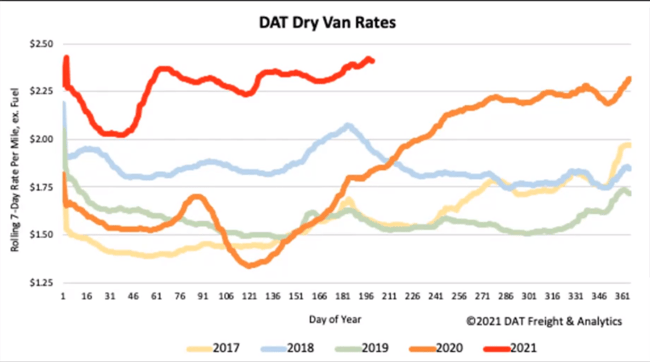

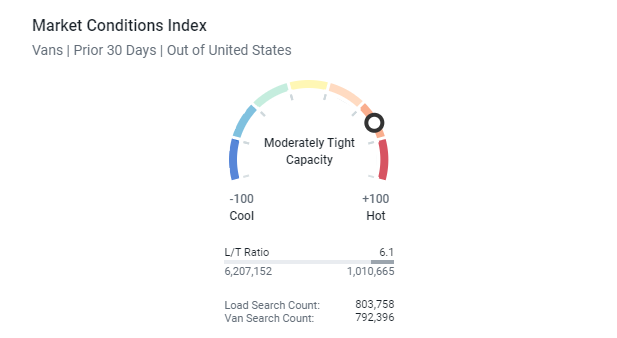

Dry Van rates have been flat over the last month with a decrease of less than 1%. This is despite the load-to-truck ratio dropping 9.2%. Spot rates are still 27%, which is $0.70 higher than last year. (Image and data source: DAT)

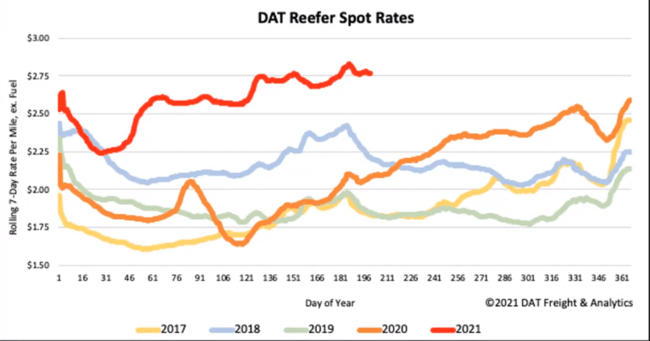

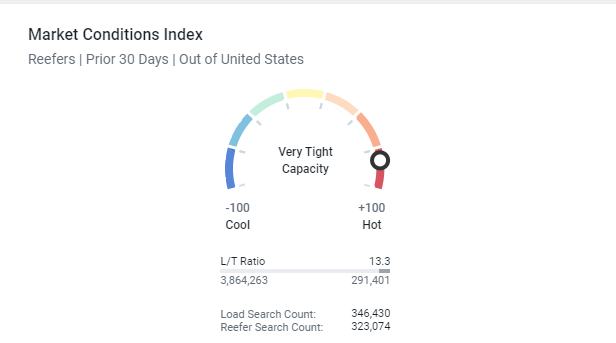

Reefer rates have also been flat with a decrease of less than 1%. This is despite the load-to-truck ratio dropping 10.6%. Spot rates are still 26%, putting them $0.70 higher than last year. (Image and data source: DAT)

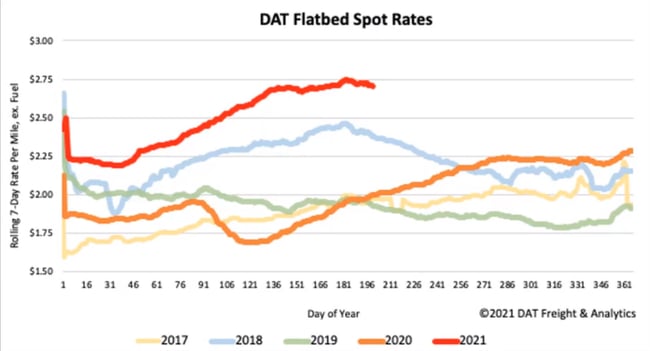

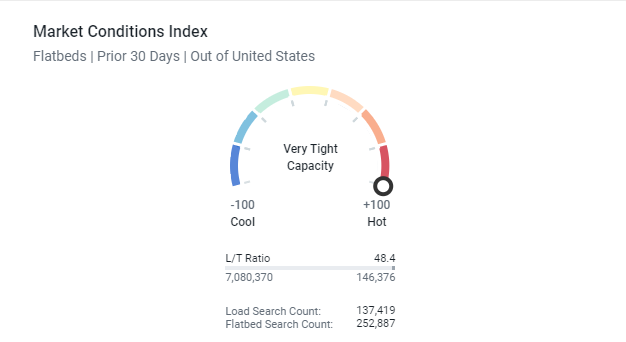

Flatbed rates have been flat with an increase of just over 1%. This is despite the load-to-truck ratio dropping a whopping 31.2%, continuing a 10-week slide in load-to-truck ratios. Spot rates are still 36%, making them $0.70 higher than last year. (Image and data source: DAT)

Where are rates going?

Rates seem to be leveling off and should remain near industry expects to see rates drop off after the July 4th holiday, but this year record volumes are instead bolstering rates. The main cause of this is inventory stocking. Inventory levels are low across the country, a direct result of COVID-19 greatly depleting workforces and, in turn, creating issues with stock and resupply. Suppliers are already prepping for the Holiday season and trying to restock their inventory levels.

What to watch for?

The one caveat to current forecasting trends is the potential impact of the 2021 hurricane season, which NOAA predicts could be more eventful than usual. Any major additional impact to the current trucking market could cause rates to jump again, perhaps even to new records.

How Technology Adoption Will Impact Freight Brokers This Hurricane Season

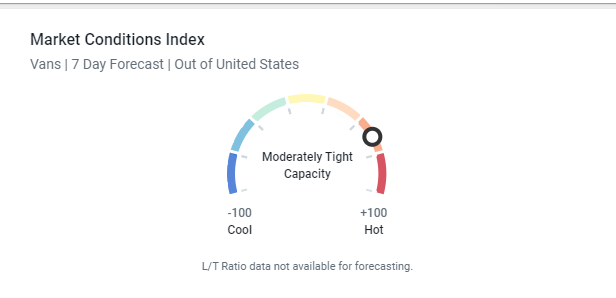

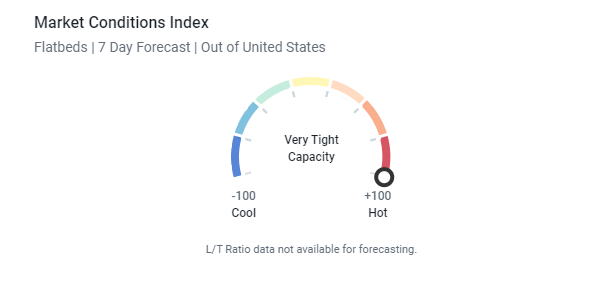

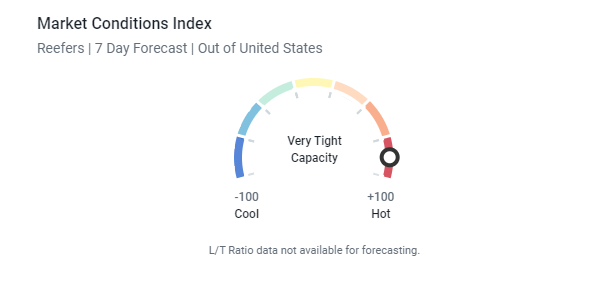

Check out these snapshots to gain more insight into current market conditions.

Spread the Word

Do you know someone in the industry who could benefit from a snapshot and analysis of the market today? Share this post or comment below - we welcome feedback from our community!

Subscribe to our blog today and get these updates in your inbox!

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)