Market Insights: Worker Strike Season Strikes Again

Freight/Shipping Trends | Industry News | Logistics | Transportation | Freight Rates | News

In this September edition of our Market Insights, we take a closer look at the latest trends, challenges, and opportunities shaping the industry. From steady spot rates in the van, reefer, and flatbed markets to mounting tensions with the United Auto Workers (UAW), we examine what's steering the market this month.

To stay ahead of the evolving market and gain a competitive edge, subscribe to our blog, where we unravel the intricacies of the market dynamics, offering you a gateway to informed and strategic decision-making.

September Notables

- Van, reefer, and flatbed spot rates have remained steady over the last six weeks

- Contract rates continue to decrease

- Import volumes are at their highest levels for the year

- United Auto Workers (UAW) threaten to strike

A Look at Rates

Dry Van

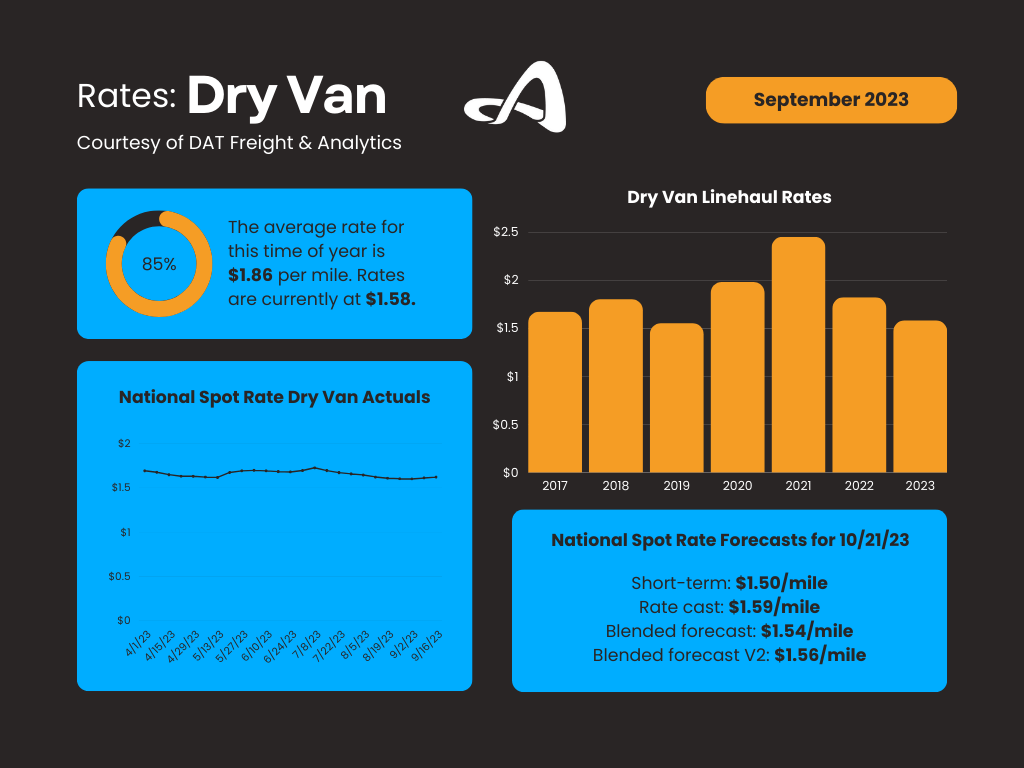

The dry van market is following a seasonally normal trend and has remained flat over the past six weeks, meaning that spot rates are bottoming out and will most likely have a slow recovery. Current rates are about $0.25/mile lower than last year and only $0.02/mile higher than in 2019. Hot markets to pay attention to include the Midwest going into Texas and any outbound freight from the Pacific Northwest. September marks the functional end of the Midwest growing season - harvesting apples, pumpkins, cabbages, tomatoes, squash, and green beans all need to get to warehouses, grocers, and canners nationwide.

Similar to our forecast from last month, we expect to see downward pressure on dry van rates. Seasonal norms show rates tend to flatten out and decrease going into October, staying that way until we hit the holiday season. One thing we need to watch over the next month is the potential UAW strike that could have a significant negative impact on rates.

Reefer

Like dry van, reefer spot rates have been flat for over six weeks. Seasonal norms predict reefer rates will increase at the end of October into November when the produce market shifts to the south as winter fresh vegetables begin to move - bell peppers, cucumbers, squash, and snap beans. Current rates are about $0.25/mile lower than this time last year and only $0.07/mile higher than in 2019. Similar to dry freight, hot markets include the outbound Northern Midwest and any outbound from the Pacific Northwest. We expect both markets to tighten up as we move into Q4.

With a slower-than-average pre-holiday push, we are not seeing much upward pressure on reefer rates. We predict they will continue downward slightly until the end of October, when seasonal volumes should help boost them back up.

.png?width=1024&height=768&name=Market%20Insights%20-%2092023%20(1).png)

Flatbed

Flatbed rates have also been steady for the last six weeks, now down $0.22/mile since June. Current rates are $0.24/mile lower than this time last year and $0.03/mile higher than in 2019. New single-family housing construction has decreased by 4% over the previous month, putting more downward pressure on flatbed rates. The only areas reporting shortages of trucks are the Pacific Northwest (more specifically, Oregon) and the Southeast (eastern Texas, Louisiana, Mississippi, and Georgia).

The flatbed market continues to see a slowdown in freight this year. With fewer shipments, there is increasing pressure to continue lowering rates. The good news is that rates have been more resilient over the past few weeks, and we expect that resilience to continue over the next month. Due to the nature of flatbed freight and how high rates went, there is still room for them to continue to decrease through the rest of the year.

.png?width=1024&height=768&name=Market%20Insights%20-%2092023%20(2).png)

Imports

According to the US Bureau of Economics, US imports increased nationally by 2% month-over-month. Imports increased by $5.2 billion in August, the highest level of 2023. Import volumes are down 14% year-over-year, primarily due to rising interest rates.

Rail

With the unions having ratified new contracts, the railroads look poised for a recovery in the next few months. The negative press and inconsistent service are beginning to fade. Additionally, as over-the-road rates increase in the second half of Q4, the difference between rates moving over the road and on the rail will widen, helping to push more freight back to the railways.

Fuel

Diesel prices have increased by another $0.24/gallon over the past month, but they're still down an average of $0.33/gallon compared to last year. Diesel forecasts predict increases in the short term, while long-term forecasts expect prices to drop next year based on predictions that the US economy is headed for an upturn. This optimism about an improved economy raises concerns that the already limited fuel inventories may become even scarcer.

United Auto Workers Strike

The UAW threatens to expand their strike unless substantial progress is made by September 22. The location of these strikes has still not been released. Currently, the strike is limited to around 13,000 workers. The expansion of the strike could impact over 146,000 autoworkers and spread into Canada and Mexico. A strike of this size will affect multiple areas in our supply chain and significantly impact all aspects of freight. The largest impact will be on the dry van market, followed closely by the flatbed sector.

The Road to Industry Expertise

In a constantly evolving logistics landscape, staying informed is paramount. Harness the power of data-driven insights and industry forecasts by diving deeper into our blog. Don't miss out on the opportunity to stay ahead of the curve; subscribe now and position yourself at the forefront of thought leadership.

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)