Market Insights: The Summer Flatbed Market Looks Flat

Freight/Shipping Trends | Industry News | Logistics | Transportation | Freight Rates | News

In this edition of Market Insights, we'll look at notable trends in June. If you're involved in the transportation industry or are interested in logistics, check out our blog, Fuel for Thought. Subscribe to stay updated on the latest industry news and trends!

Let's dive in.

June Notables

- Van, reefer, and flatbed rates continue to decline after a short bump

- Van contract rates are down an average of 9%

- Reefer contracts are down an average of 15%

- Imports are up 3%, but the outlook looks to be slowing

A Look at Rates

Dry Van

-1.png?width=900&height=512&name=image001%20(1)-1.png)

Dry van spot volumes have dropped back to April levels, erasing all the gains seen last month. Last week saw a roughly 20% decrease in load posts on DAT, around 50% less than this time last year. While van rates are significantly down year-over-year, they are still higher than they were this time of year before the pandemic.

One of the strongest dry van markets in the country right now is California. The increase in imports has had a substantial impact on capacity. The other major factor is that warehouse moves have increased in the state, taking up some availability. Despite the strong demand in California, dry van spot rates have dropped by $0.01/mile nationally. This is still $0.09/mile higher than last month but around $0.29/mile lower than this time last year.

-1.png?width=839&height=515&name=image002%20(1)-1.png)

Despite the relatively flat rates seen over the past month, DAT's forecast predicts strong gains over the next three or four weeks; however, after the week of the 4th of July, we expect a pullback and rates to flatten out until Q4.

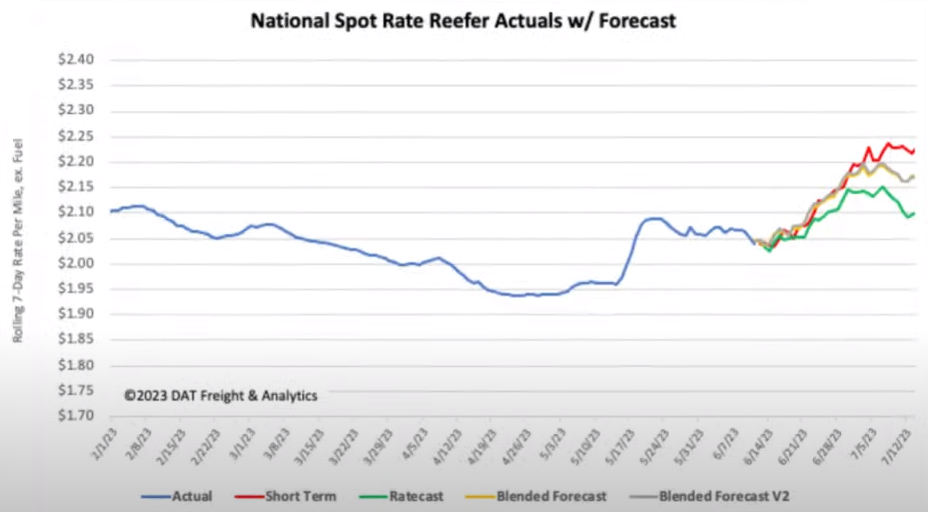

Reefer

-1.png?width=930&height=467&name=image004%20(1)-1.png)

Reefer volumes are still seeing small increases due to the late produce season. This year produce volumes are around 4% lower than this time last year, according to the USDA, causing the reefer market to remain fairly loose. The USDA also reports a truck shortage along the border from McAllen to Calexico. The main reason is that demand for produce from Mexico is staying unseasonably strong.

With produce picking up, Arizona and California remain two of the most vital states in the reefer market. We can expect Arizona to slow down after the 4th of July as the primary type of produce moving, watermelons, will see a sharp decrease in demand. Southern Arizona has seen rates jump as much as $0.23/mile in one week. Similarly, California has seen reefer rates increase by as much as $0.14/mile.

On the other side of the country in Florida, rates have dropped by over $0.34/mile now that Mother's Day has passed and produce season in the Southeast is cooling. Like dry van spot rates, reefer spot rates, while strong in the West, dropped $0.02/mile. This is $0.23/mile lower than this time last year.

While reefer produce volumes are seeing some late-season increases, the overall demand for reefer freight remains weak for this time of year. We do expect rates to increase through the week of the 4th of July, but after that, we'll see a quick pullback. We also predict that this year's peaks will not be as significant as the past few years. DAT's forecast predicts only a $0.10/mile increase going into the 4th; a typical year sees around $0.30/mile.

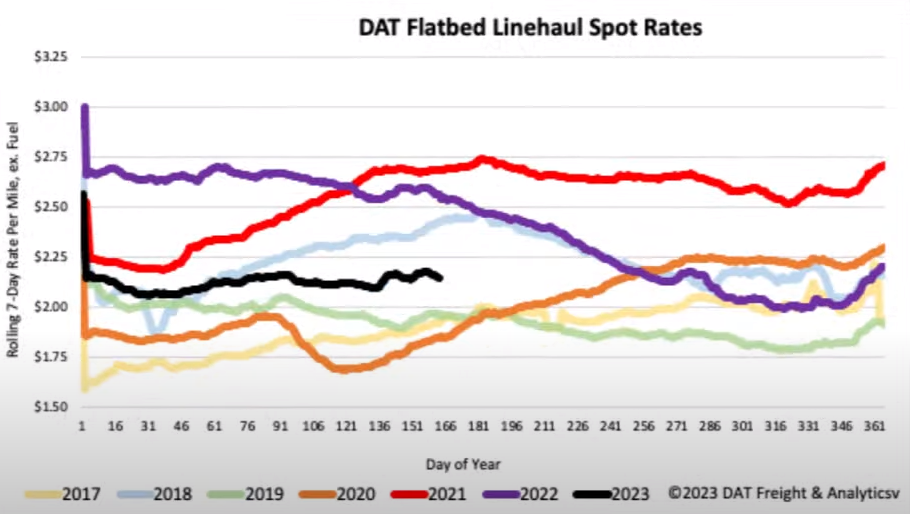

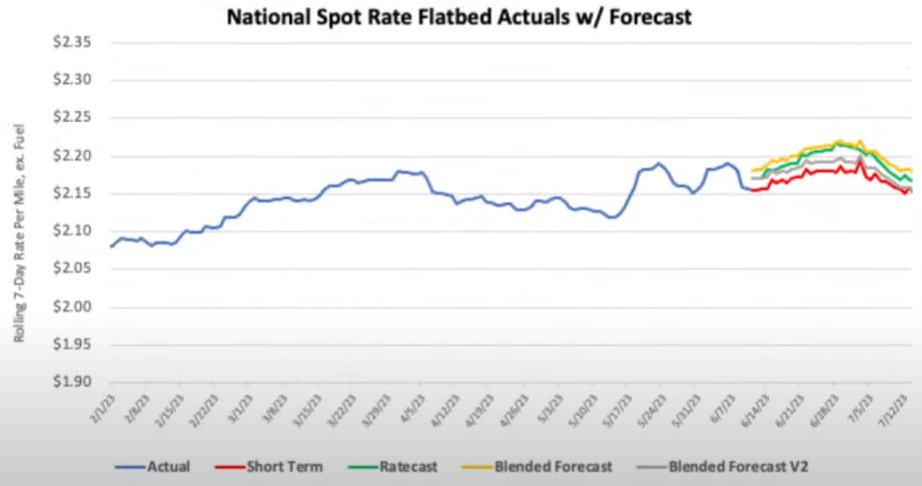

Flatbed

Flatbed volumes are at their lowest level in seven years, around 39% lower than pre-pandemic levels in 2019. Two markets that did manage to have a decrease in available capacity are the Pacific Northwest and the Southeast. Oregon's flatbed rates are the highest they have been in the last eight years. Despite Oregon's tight market, flatbed spot rates have dropped $0.05/mile nationally. This is $0.42/mile lower than this time last year.

The flatbed market overall is struggling to find freight. Usually, this time of year would be its peak season. Only areas like Portland, Texas, Alabama, and Georgia are seeing healthy volumes while the rest of the country struggles. In the short term, we can expect a slight increase in the national average cost for a flatbed until the 4th of July, with rates dropping off again after.

Imports

US imports increased nationally by 3% month-over-month. However, importers are showing caution going into the second half of the year due to concerns about consumer spending. Inventory levels jumped late last year as consumer spending missed expectations, and we are only now starting to see inventory levels return to a normal level. FreightWaves' Sonar predicts import container booking to drop as soon as August this year, with a 10-20% drop in monthly import TEUs expected.

Rail

Rail volumes saw a minimal gain of 0.8-1.8% depending on the rail line. With roughly 50% of intermodal shipments tied to international trade, the increase in imports has had a small benefit to rail lines. With US port volumes predicted to trend downward in the year's second half, the rail outlook for the remainder of 2023 is not great. The declining rail market has even caused some larger intermodal companies, like Tiger Cool Express, to shut their doors.

Fuel

Diesel prices have continued their downward trend over the past month, despite cuts from OPEC in oil production. Diesel prices fell an average of $0.10/gallon over the last month, down $1.924/gallon from this time last year. The EIA expects diesel prices to average $3.90/gallon this year and to drop to $3.62/gallon in 2024.

In an Ever-Evolving Industry, Knowledge is Power

Despite the challenges, there are still opportunities for businesses to navigate this dynamic transportation environment successfully. Whether you're a trucking company, a freight broker, or simply interested in the world of transportation, our blog will provide you with the knowledge you need to make informed decisions. Subscribe today and let us be a trusted source of transportation news and insights!

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)