Market Insights: Spot Rates Cool as Temps Rise

Industry News | Logistics | Transportation | carriers | Freight Management | Shippers | Freight Broker

It's the last month of spring, but Slip N' Slides - a backyard summer mainstay - may be making early annual debuts on lawns across the southern and eastern U.S. amid warmer than average temps. In fact, the entire U.S. economy seems to be tracking the Slip N' Slide theme.

This month, stocks have seen a few wild swings as a market that seemed to defy gravity is now returning to earth. Consumer spending, which was on a tear during the pandemic, is dipping in the face of near-record inflation and favoring services more heavily than goods.The U.S. freight industry is seeing more significant fluctuations in transportation where spot rates are declining, and capacity is returning to the market for the first time since May 2020. May headlines seem to indicate consensus around growth, albeit slower than what we've seen in the past 18 months.

All eyes are on soaring diesel prices, which create headaches for truckers and have consumers eyeing the potential impact of higher transportation costs on their wallets. The national U.S. average price for diesel is now $5.56, its highest on record.

Like what you're reading? Click Subscribe at the top of this post and receive weekly updates straight to your Inbox!

May Notables

- Annual DOT week took place this week -- May 17-19, 2022. Capacity is generally tighter, and transit slows during the inspection blitz on North American highways. With a focus on Wheel Ends, an average of 15 trucks are inspected per minute during the 72 hours.

- Produce season is off to a slow start, but expect the boom to come anytime, with spot rates for dry vans and reefers expected to peak around July 4.

- Fuel prices spiked this week. When they increased last month, it didn't dramatically affect rates, but everyone is watching the potential impact closely.

- Spot rates continue to slide while East Coast ports are now seeing record volume.

Looking to limit transportation disruptions? Connect with Armstrong for access to a network of more than 55,000 vetted, reliable North American carriers.

A Closer Look at Freight Rates

Dry Van

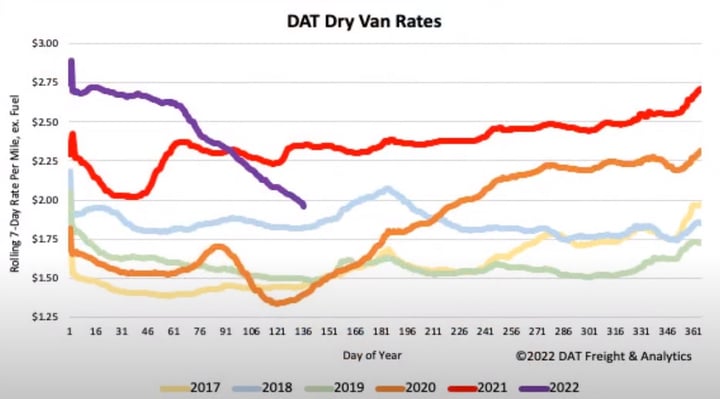

Dry van spot rates have continued their downward trend over the last month. Rates are currently down around $0.20/mile compared to last month, and $0.39/mile compared to last year. The southeastern U.S., where produce season is in full swing, is the only area where we've seen rates increase in the previous three weeks. We expect to see elevated rates through the end of the produce season. (Image and data source: DAT)

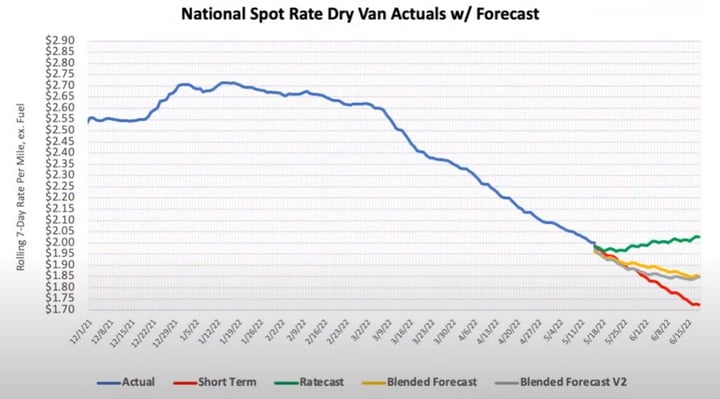

Armstrong continues to see a lot of divergence in forecasting models, primarily caused by the unseasonal decrease in rates outside the historical norm. Over the next month, expect to see rates continue downward before leveling out in June. The yellow blended forecast depicted in the graphic below appears to be the most likely scenario. (Image and data source: DAT)

Reefer

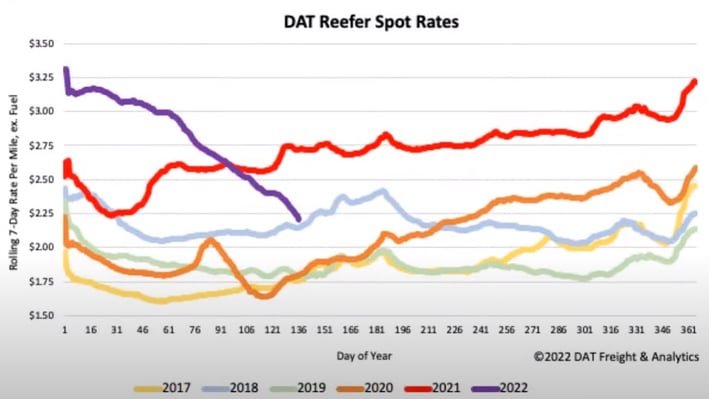

Reefer spot rates have continued their downward trend over the last month, opposite of what will typically happen during the spring season. Reefer spot rates dropped around $0.30/mile in the previous month, $0.90/mile since the beginning of the year, and $0.51/mile lower than this time last year. A slow start to the produce season and looser capacity is contributing to this late-season decrease. However, freight volumes are increasing, primarily attributed to produce, with the southeast being the only market to see rate increases. This increase was caused mainly by Florida produce and a Mother's Day push, but capacity is still reasonably available, so rates did not increase as much as in the dry van sector for the southeast. Armstrong expects to see California rates tick up in the next couple of weeks. We are currently witnessing rates $0.50-0.80/mile lower out of California than this time last year. (Image and data source: DAT)

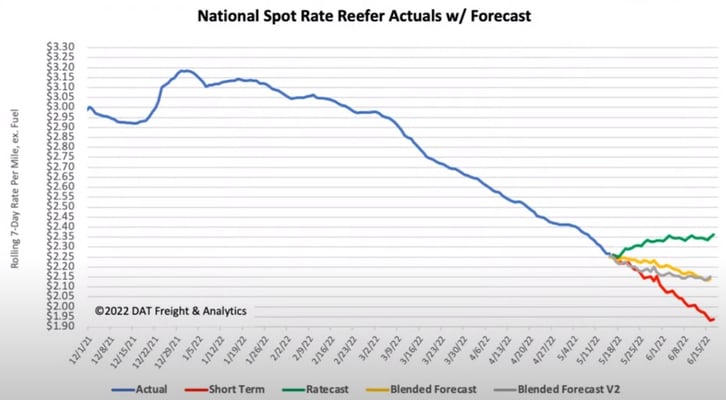

Like the dry van forecast, we continue to see a lot of divergence in the reefer forecasting models. An unseasonal decrease in rates is outside of the historical norm. What does the next month hold? Armstrong expects rates to continue downward for the short term before leveling out in June. The yellow blended forecast looks to be the most likely scenario, except that we expect to see California rates begin to slowly increase as produce volumes continue to grow. (Image and data source: DAT)

Flatbed

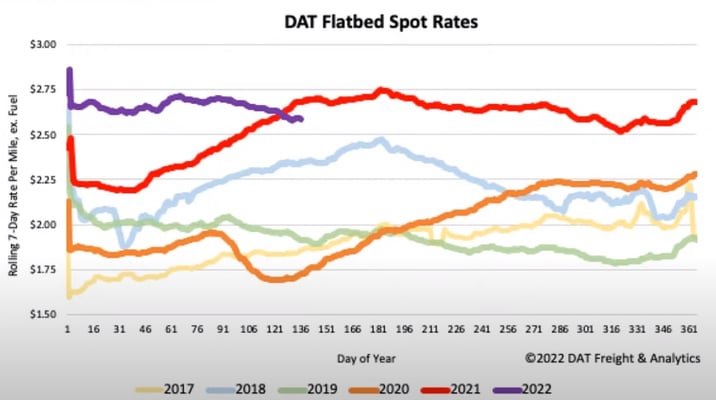

Flatbed spot rates have now dropped five weeks in a row, now down $0.10/mile over the last month, $0.06/mile since the beginning of the year, and $0.10/mile compared to this time last year. Truck postings have gone up and are now almost double what they were this time last year. Indicators show that capacity is looser, which rate decreases reflect. Much of the decline in rates is caused by the decrease in output from the U.S. steel market. (Image and data source: DAT)

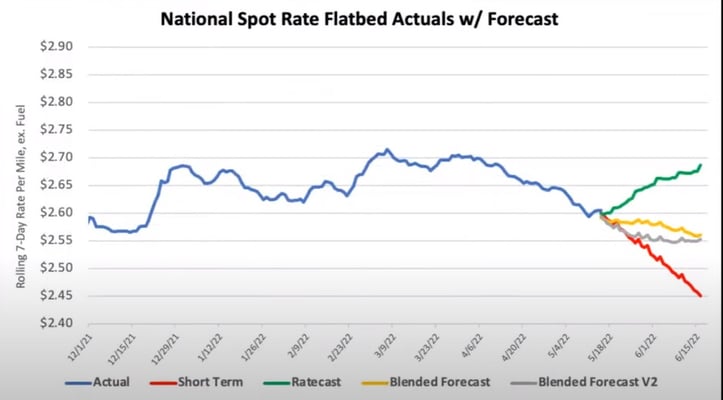

As with the dry van and reefer forecasts, we continue to see a lot of divergence in the forecasting models for flatbeds. The market is seeing an unseasonal decrease in rates outside the historical norm. The green DAT Ratecast line shows what would typically happen in a typical season. However, since demand has been decreasing steadily over the last five weeks, we expect to deviate from that line. Armstrong anticipates that flatbed rates will flatten out over the next month, possibly decreasing rates. (Image and data source: DAT)

Imports

Inbound volume to East Coast ports has reached record levels. West Coast volumes are still very low compared to the last few years, with the expectation that volumes will continue to remain low until China exits its latest Covid shutdown. China has been reporting improvements in its Covid levels and is showing signs of possibly reopening before the end of May. During July, a surge in Chinese export activity could create a noticeable spike in U.S. import volumes.

Fuel

Diesel prices remain as volatile as ever as the world continues to navigate a tightening global diesel market amid inventory drops.

Spread the Word

Like what you're reading? Check back with us monthly to stay up to speed on freight market conditions. Our snapshots compile market data from reputable public sources to help you stay informed.

Do you know someone in the industry who could benefit from a snapshot and analysis of the market today? Share this post or comment below - we welcome feedback from our community!

Subscribe to our blog today and get these updates in your Inbox.

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)