Market Insights: Navigating the Freight 'Fright' as Rates Chill and Volumes Shiver

Freight/Shipping Trends | Industry News | Logistics | Transportation | Freight Rates | News

With the backdrop of global conflicts, pandemics, and economic fluctuations, our latest edition of market insights aims to illuminate trends in transportation and offer a deeper understanding of the freight market's current trajectory.

Key Points

- Van and reefer spot rates have decreased slightly over the last month

- Contract rates continue to decline, moving closer to spot rates, but the degree to which rates are dropping has decreased

- Volumes decrease slightly month-over-month

A Look at Rates

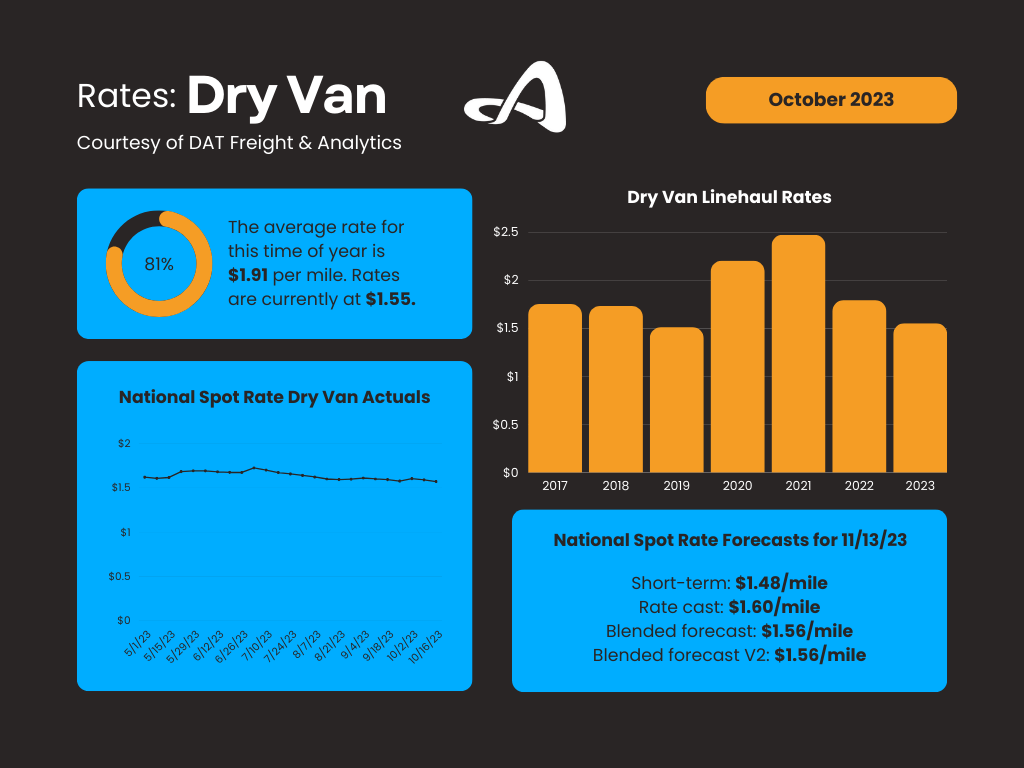

Dry Van

Unlike the past six months, dry van rates are starting to break away from typical seasonal trends and have decreased about $0.10/mile over the last month. Rates nationally are only around $0.05/mile higher than in 2019, before the pandemic. Usually, they increase this time of year as companies prepare for the holiday season. Higher interest rates and lower consumer demand are likely reasons for the decreases in shipping volumes.

The unseasonal downward trend in dry van spot rates has caused a considerable divergence in DAT's forecasting model. We believe dry van spot rates will start to recover over the last quarter of 2023, and we will see a normal seasonal increase until the first quarter of 2024.

Reefer

Like dry van, reefer spot rates have dipped slightly over the past month. The leading cause is a decrease in produce volumes. According to the USDA, volumes are down around 13% year-over-year. California has the highest volume count, but that is expected to shift to Yuma and Mexico over the next month. Apples, onions, and potatoes are starting to come into season in the Pacific Northwest, helping drive volumes up in that region, one of the only regions seeing rates increase. Currently, reefer spot rates are around $0.26/mile lower than this time last year.

With consumer demand continuing to decrease, we are seeing less produce moving in the market and less upward pressure going into the holiday season. We expect to see slight decreases in reefer rates until the Thanksgiving holiday, and then a continuation upward through the end of the year.

.png?width=1024&height=768&name=Market%20Insights%20-%20102023%20(1).png)

Flatbed

Flatbed rates have remained flat over the last ten weeks, currently $0.28/mile lower than this time last year and exactly where rates were in 2019. Unlike the van and reefer sectors, the late-season push to finish housing and construction is likely holding flatbed rates up.

With housing starts decreasing steadily over the last few months, we expect demand for flatbed freight to continue dropping as we enter the winter season. This decrease will most likely continue until mid to late December.

.png?width=1024&height=768&name=Market%20Insights%20-%20102023%20(2).png)

Imports

The National Retail Federation (NRF), which measures imports to 12 leading US ports, said, "Cargo volumes will still be strong the rest of the year, but not as high as we expected a month ago. Retailers stocked up early this year to safeguard against supply chain issues and are well situated to meet consumer demand." The NRF decreased its previous expected import TEUs by 1.2 million. Other causes for the decrease in imports are the strong US dollar and high interest rates.

Rail

As the railroads were finally starting to see promising signs ahead, the truckload market took a step back this last month and is putting pressure on intermodal rates. Long-haul lanes that were predicted to increase have remained flat or even dropped in cost. In the long term, we expect rail to recover, but the next few months will likely see over-the-road truckload rates continue to compete with intermodal.

Fuel

Over the past month, we have seen a steep falloff in diesel demand. As conflict in the Middle East intensifies, the US has started to stockpile diesel and gasoline reserves. This, combined with a sharp decrease in consumer demand, has allowed average diesel prices to drop $0.19/gallon over the last month. Forecasts on where oil prices will go are uncertain as we watch developments with the Israel-Hamas war.

Why the Slow Recovery?

One of the biggest questions is when the "freight recession" will end. The answer isn’t clear-cut, considering the thousands of variables that play into the market. We can, however, look at history and key indicators to give us an idea. The freight market goes through a whole freight cycle every five years. We are currently a little over 1.5 years from the last peak. This means that if we follow a typical cycle, we will see rates bottom out and start to push upwards.

Why did rates drop over the past month? The main reason relates to the pandemic’s impact. For rates to rise again, we either need a substantial increase in shipping volumes or a notable reduction in trucks. Before the pandemic, it was typical to see about 200 new MCs activated weekly. However, from August 2020 to September 2022, the average jumped to 1,124 new MC activations per week. This influx resulted in 63,000 more fleets than what was typical before the pandemic.

Why did rates drop over the past month? The main reason relates to the pandemic’s impact. For rates to rise again, we either need a substantial increase in shipping volumes or a notable reduction in trucks. Before the pandemic, it was typical to see about 200 new MCs activated weekly. However, from August 2020 to September 2022, the average jumped to 1,124 new MC activations per week. This influx resulted in 63,000 more fleets than what was typical before the pandemic.

Since September 2022, the market has seen an average decrease of 435 fleets per week, and it will take over a year for fleet levels to be the same as before the pandemic. Companies are also closing at a slower pace than is historically normal because the profits they made during the prior 2.5 years have been enough to keep them going. As those excess funds start to decrease, we can expect to see an uptick in companies closing their doors and the market correcting faster.

Steer Your Business With Insights That Matter

The freight industry, like many others, is susceptible to the ebbs and flows of global events and market demands. There are many influences – from the aftermath of the pandemic to the geopolitical events in the Middle East. And as the "freight recession" continues its course, we're left to figure out its patterns, drawing parallels with historical data and anticipating the future.

Even with all these unknowns, one thing is clear: adaptability and informed decision-making will be crucial for stakeholders to navigate this dynamic landscape. Stay in tune with the market by subscribing to our blog.

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)