Market Insights: Navigating February's Frosty Figures with Love

Freight/Shipping Trends | Industry News | Business Advice | Logistics | Transportation | Freight Rates | Shippers | Freight Broker | News

As we progress through the first quarter of 2024, the transportation and logistics industry is riding the waves of fluctuating market dynamics. In this edition of Market Insights, we dissect the current freight economic climate, highlighting spot rates, contract rates, and load-to-truck ratios across various transport modes. Additionally, we consider the impact of seasonal trends and international events on these figures.

Our in-depth analysis paints an up-to-date picture of the marketplace, empowering industry stakeholders with the actionable knowledge required for strategic decision-making. Subscribe to our blog for direct access to these insights in your inbox and share them with those who could benefit from a comprehensive market snapshot.

February Notables

- Van, reefer, and flatbed spot rates fall for the third straight week

- Contract rates continue to decrease an average of 8% as bid season starts to come to an end

- DAT's load-to-truck ratio for van, reefer, and flatbed are the lowest they've been in over seven years

- Imports surged in January for the largest month-over-month growth in seven years

A Look at Rates

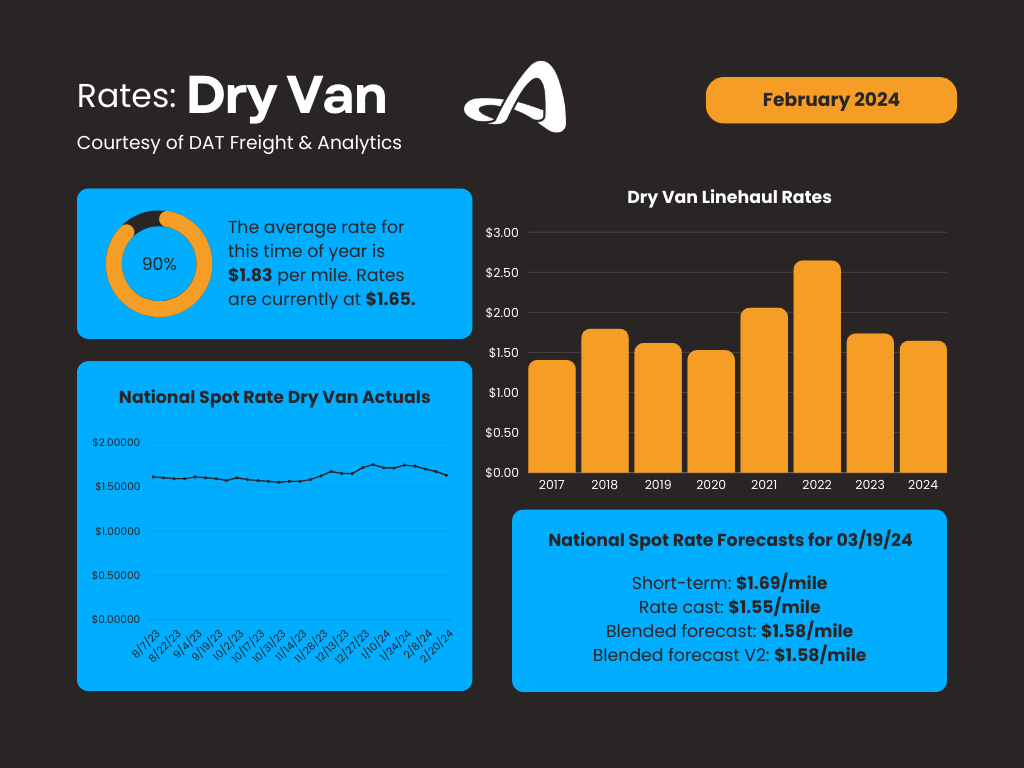

Dry Van

The dry van load-to-truck ratio is the lowest it's been since 2017, a decrease of 61% year-over-year. Spot volumes have fallen dramatically over the last few months, causing spot market rates to continue trending downward. Even with the severe weather we saw in January temporarily causing some capacity issues that caused rates to spike, we are now seeing rates below their prior levels. Dry van spot rates have dropped an average of $0.16/mile in just the last two weeks, making them $0.13/mile lower year-over-year and $0.01/mile lower than this time in 2019.

DAT's forecast model is slightly varied right now due to the unseasonable spike we saw in January. Their short-term forecast, the red line, is still trying to materialize an increase. Their longer-term forecast model, Ratecast, the green line, shows more of what we expect to see for the remainder of February into the middle of March. Rates will likely continue to decrease due to a lack of freight, but we expect rates to increase again in late March/mid-April.

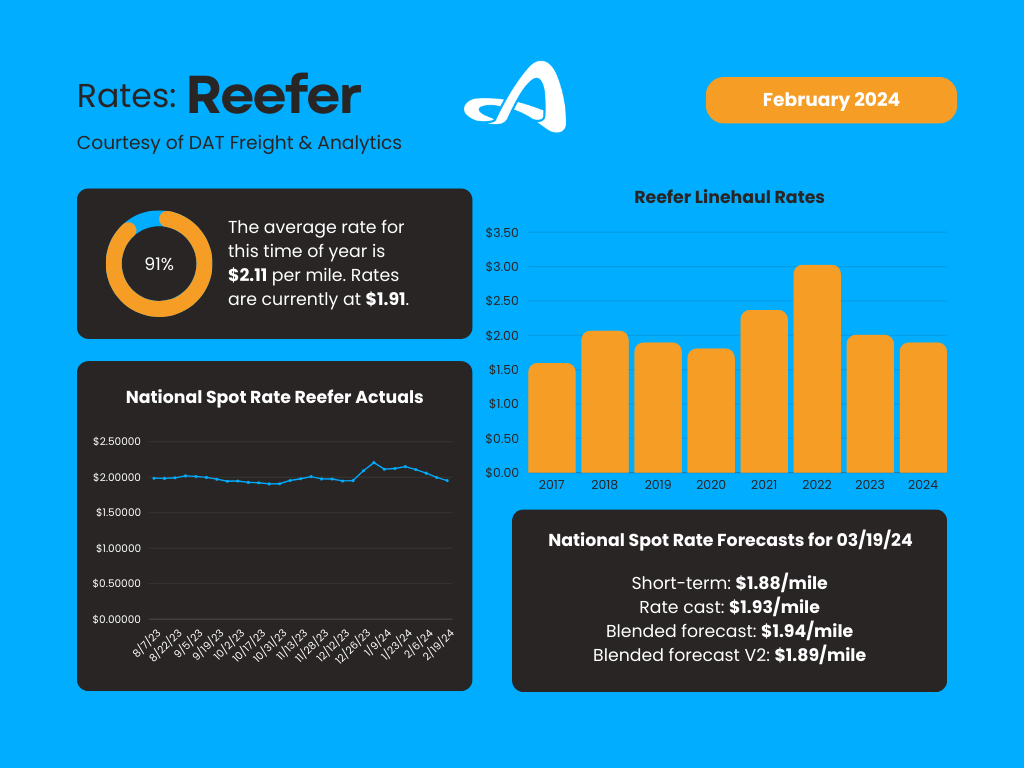

Reefer

Like dry van, reefer load-to-truck ratios have reached their lowest level in eight years, a decrease of over 60% year-over-year. The leading cause for this drop is the low level of produce volumes shipping right now. Reefer spot rates have dropped for four weeks, dropping $0.12/mile over just the last two weeks and $0.20/mile in the previous month. This is about $0.12/mile lower than last year and even with spot rates this time in 2019.

DAT's reefer rates forecast is in closer alignment, showing a slight increase until the end of February and then dropping through March. The small increase is most likely due to the bad weather we have historically experienced in late February. If the weather stays calm, we expect rates to remain relatively level or drop over the next few weeks.

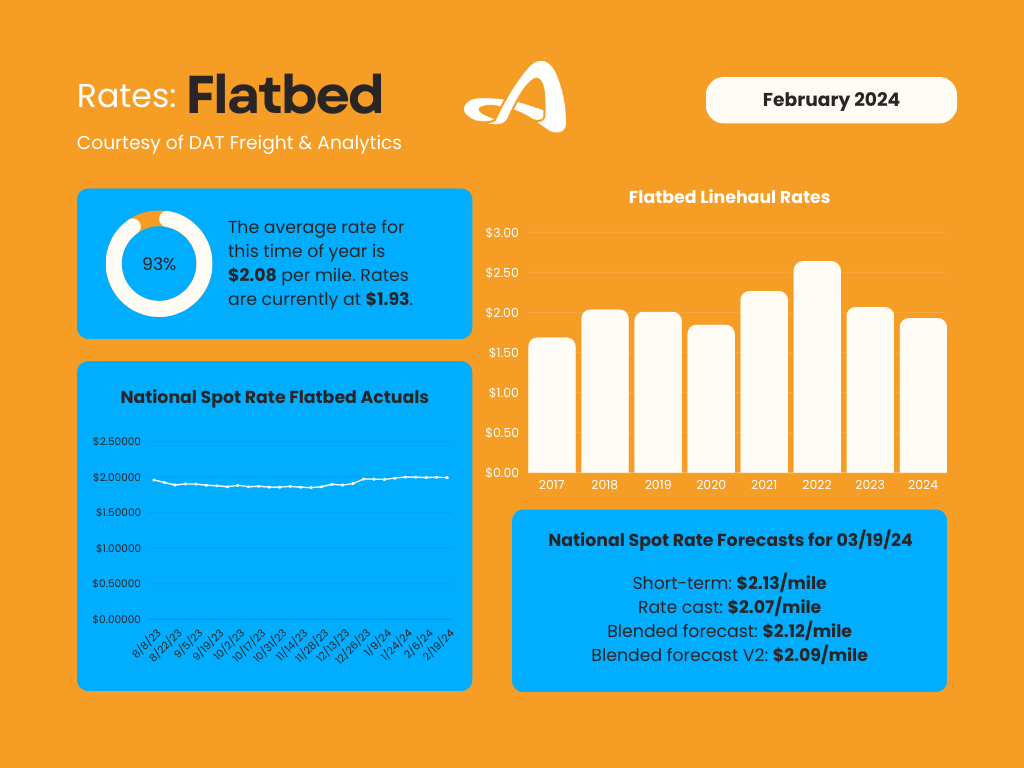

Flatbed

Flatbed spot rates have declined for three weeks but have remained relatively flat, decreasing just $0.06/mile over the last three weeks. This makes flatbed spot rates $0.13/mile lower year-over-year and $0.09/mile lower than this time in 2019.

Housing starts dropped 15% month-over-month, which is seasonally normal this time of year but does lower some of the demand for flatbed freight. We expect rates to remain fairly flat until March and then see consistent gains through summer.

Imports

Imports have seen a 10% month-over-month increase, the largest increase in January in the last seven years. We are also witnessing imports shift back to the West Coast. Over the past 2-3 years, imports have been moving eastward due to extreme delays in the west. With the backlog long gone and labor disputes in the past, the West Coast is now a desirable and cheaper option again. We expect to see imports continue to shift westward throughout the year.

Rail

Railroads have struggled over the last few years due to poor service, labor disputes, and rate competition compared to over-the-road. We expect rail to make a comeback this year as the first two issues have been corrected, and OTR rates are expected to increase throughout the summer.

Stay Ahead with Our Freight Market Insights

The transportation arena is adjusting to new rhythms, marked by a combination of declining spot rates, evolving import patterns, and rail sector recovery efforts. Amid the typical seasonal downshift, factors such as global conflicts and volatile fuel prices introduce additional unpredictability into our market forecasts.

As February concludes, industry participants must stay alert and flexible to the market's dynamic shifts. We're on the cusp of a market rebalance, with expectations of a resurgence in activity as we approach spring. Remember, in the fast-paced world of freight and logistics, having the foresight and adaptability to navigate these changes is crucial. Subscribe to our blog for ongoing insights that keep you informed and prepared.

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)