Market Insights: May Winds of Change Bring an Increase in Imports and a Decrease in Truck Orders

Freight/Shipping Trends | Industry News | Logistics | Transportation | Freight Rates | News

Welcome to our latest Market Insights blog, where we bring you the most up-to-date information on the current trends in the transportation industry. We'll examine the latest rates in the dry van, reefer, and flatbed sectors and explore the impact of imports on the overall industry. We'll also look at the state of rail transportation and fuel prices.

Before we dive into the details, don't forget to visit our blog to access more valuable content. By subscribing, you'll receive our Market Insights straight to your inbox each month. Let's stay ahead of the curve together!

May Notables

- Van, reefer, and flatbed rates continue to decline after a short bump

- Contract rates lag behind spot rates, about $0.30/mile higher

- New truck orders are down 39%

- Imports are up 16%

A Look at Rates

Dry Van

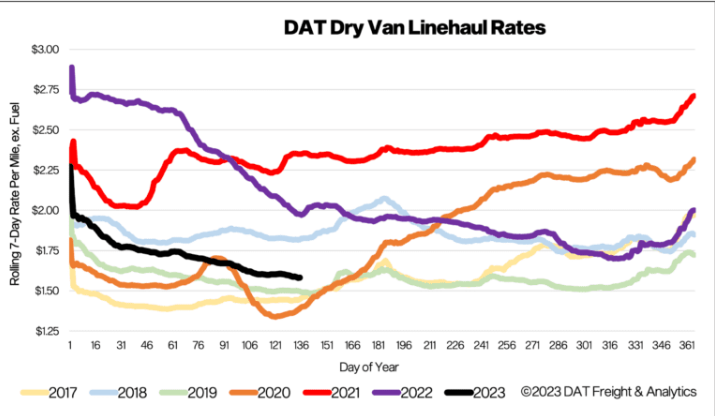

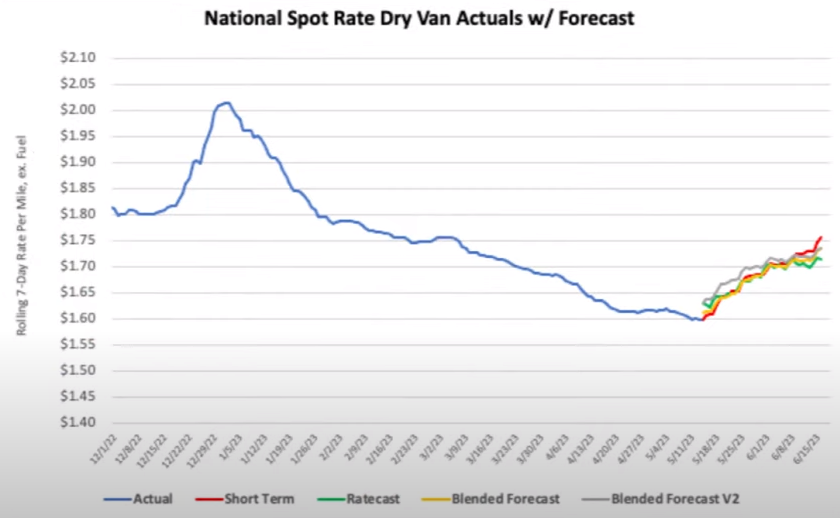

Dry van load volumes have dropped an average of 6% nationwide over the last year, continuing the pressure on rate decreases. Compared to the previous year, the only region in the US that has seen an increase year-over-year is the Southwest. There, volumes have risen around 5% over the last quarter, and it's the only market with volume growth. Coming off a significantly lower performance last year, the Southwest is currently benefitting from a notable shift in imports.

The Southwest is also seeing strong demand for freight from Mexico. Capacity in the Los Angeles market has now tightened for five straight weeks, with an average $0.21/mile increase over the last month. Notably, $0.11/mile of that increase was in the previous week alone. Produce season has also strengthened in California, helping push rates up statewide by an average of $0.20/mile, $0.09/mile of which was just in the last week.

Volumes in the Southeast are beginning to trend downward after over a month of gains. With produce season winding down, volumes are dropping around 7%. Rates in the Southeast were flat month-over-month but have seen a sharp jump of about $0.11/mile in just the last week. We are seeing steady rate increases from most markets over the previous week and a half. This could represent a floor in national rates, which have increased on average $0.07/mile over the last week alone, with heavier volume lanes averaging a $0.22/mile increase.

As we predicted last month, we have finally started to see rates bounce off the bottom. In the previous three market downturns (2013, 2016, and 2019), rates jumped at almost the same time in May. Also, in all three downturns, we saw rates increase from mid-May until the 4th of July. After the 4th, rates remained flat until the winter holidays.

Reefer

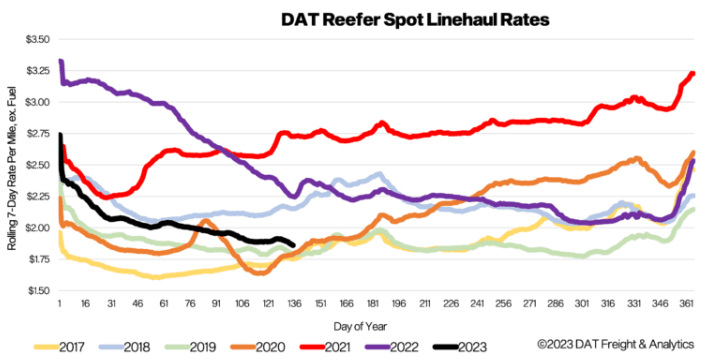

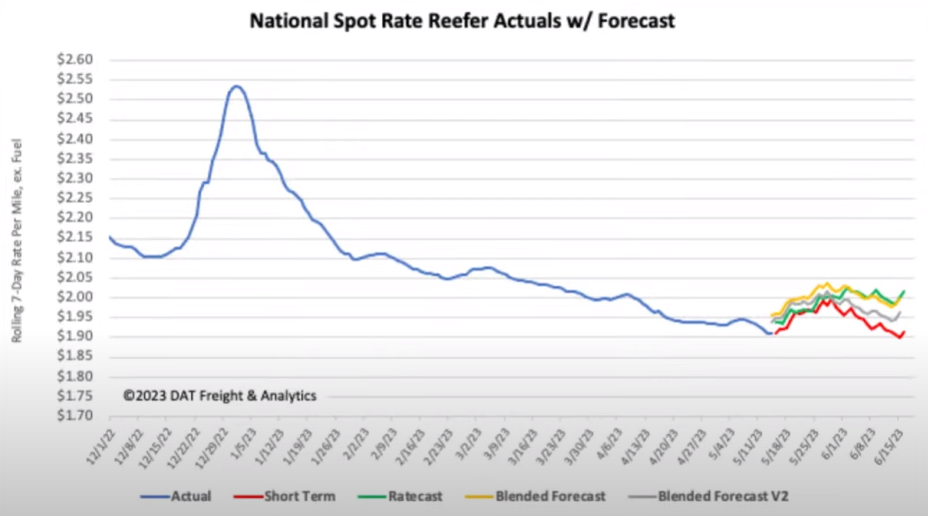

Reefer volumes are increasing as a delayed produce season in California picks up. Reefer volumes are down around 14% year-over-year, but truckload volumes have increased by over 14% since March 2023. Reefer spot market volumes on DAT spiked 60% last week during the International Roadcheck Week.

Produce season in California is one of the biggest drivers of refrigerated rates, and this year we saw a significantly delayed season due to extreme flooding in the state. However, the USDA expects produce season to gain a good amount of strength this year and be slightly more substantial than last year. The USDA also reports capacity tightening in six produce-growing regions, up from one last month.

Like the dry van market, the Southeast is starting to see volumes drop after Mother's Day; however, unlike the dry van market, reefer rates have dropped by more than $0.15/mile. National reefer spot rates have increased by almost $0.24/mile over the last week and a half. Reefer spot rates are now $0.16/mile higher than in 2019.

Similar to DAT's forecast for dry van rates, we saw a bump off the floor in the last two weeks. We expect rates to increase over the next two and a half months until the 4th of July, then level out until the winter holidays.

Flatbed

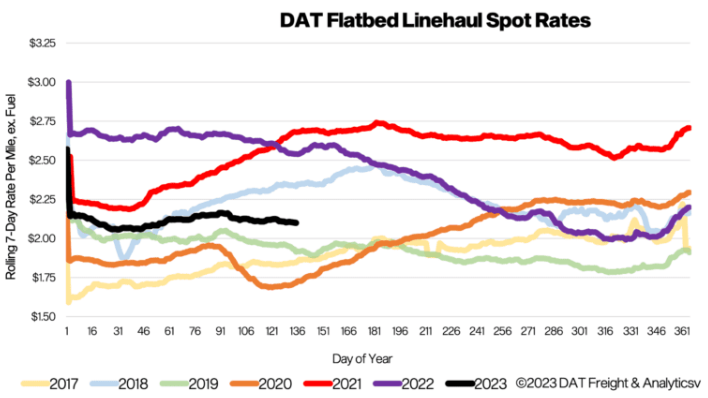

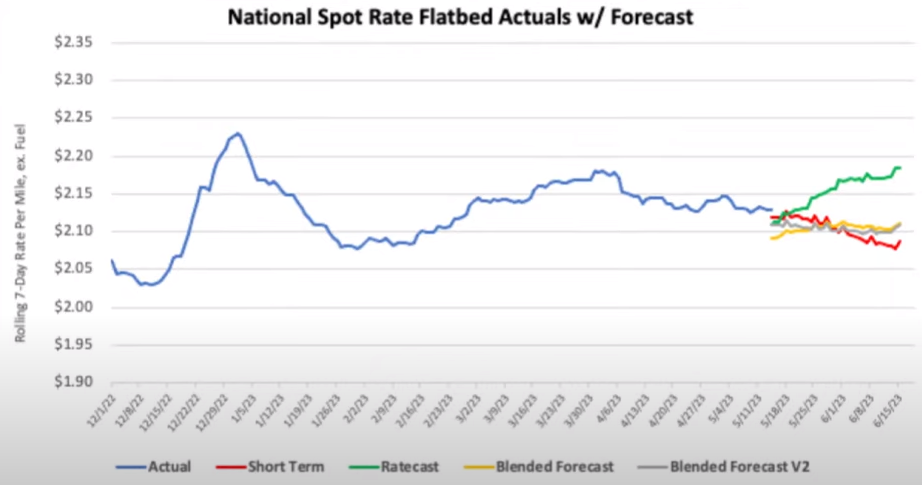

Flatbed demand has bumped up 5% month-over-month due to a spike in volume of around 16% over the last two weeks, though still approximately 73% lower nationally than this time last year. Residential construction is considerably down year-over-year, and it is one of the most freight-intensive projects in the US. While commercial and road construction are up, it's not enough to offset the drop in residential building. Flatbed rates did increase by $0.07/mile during International Roadcheck Week, but rates are still $0.39/mile lower than this time last year.

Unlike van and reefer rates, flatbed volumes will have difficulty increasing over the summer. With construction down, demand for flatbed freight is low, and this should keep rates depressed.

Imports

US imports increased nationally by 16% month-over-month. The Port of Long Beach increased by 20%. Forecasts are showing stronger imports coming this summer than were initially predicted.

Rail

Volumes remain low as over-the-road rates put pressure on the rail. Rates have yet to really drop and have remained relatively flat, even with over-the-road rates dropping for almost the last year.

Fuel

Diesel prices are currently on a downward trend and should continue barring significant changes in supply.

Thanks for Reading!

Staying informed is crucial in an ever-changing industry like transportation. Check out next month's Market Insights for the latest trends, rates, and developments! Together, let's navigate the market with knowledge and drive success in your business.

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)