Market Insights: It’s Snow Joke – Inflation is Coming Down

Freight/Shipping Trends | Industry News | Logistics | Transportation | Freight Rates | News

We’re finally nearing the end of 2022, and what a year it’s been. Between inflation, global tension, and unpredictable consumer demand, it’s difficult to forecast what the truckload market will look like in 2023. Fortunately, we know that spot rates can only go so low before bottoming out. With a sudden gnarl in the market, such as a nasty weather event or a new COVID strain, shippers could find themselves searching for capacity once again.

Without high-revenue opportunities in the spot market, many carriers and brokers are on the hunt for contract freight. Unfortunately, this drastic difference between spot and contract rates is temporary. When contract rates appear too high for shippers, and they know they can get their freight secured more cheaply on the spot market, they will. As a result, experts predict that contract rates will fall more in line with spot rates in 2023, and shippers will continue relying on mini bids throughout the year to keep costs down.

Demand issues in the broader economy are also on track to keep capacity loose. High interest rates have sharply curbed growth in finance-dependent industries like homebuilding and automotive, two industries providing significant freight demand.

On the bright side, the Bureau of Labor Statistics reported that inflation continued to decrease in November, its fifth consecutive month of decline. With the positive news, the Fed decreased its rate hikes by 25 basis points, going from 75bps to 50. Sounds to us like you’re justified in asking Santa for that portable wood-fired pizza oven after all.

Get ahead of the changes 2023 will inevitably bring by subscribing to our blog. Each month, we examine what’s going on in the freight market so you can plan ahead and make better business decisions.

December Notables

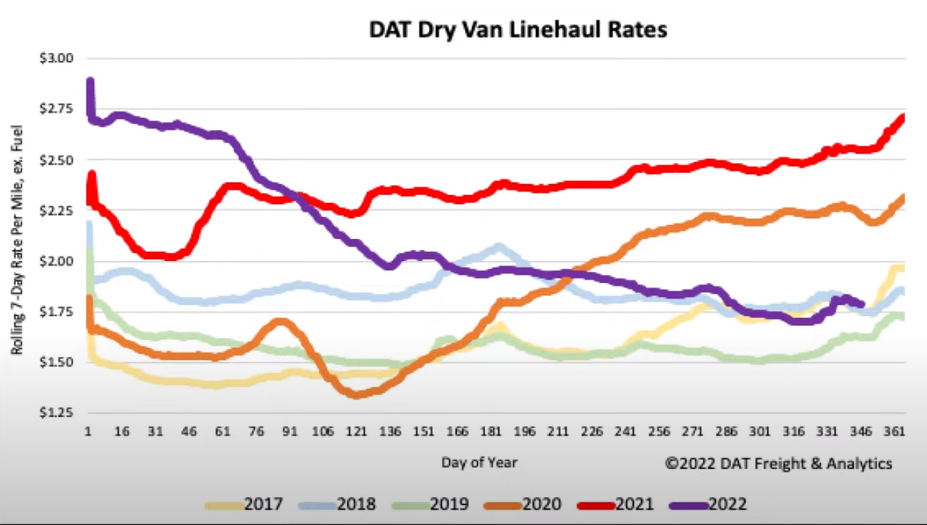

- Spot rates have bounced back a little and hover around 2017 levels

- Contract rates have fallen quickly

- Imports continue their downward trend

- The U.S. government stopped the rail union strike

- Diesel rates have started to ease

A Look at Rates

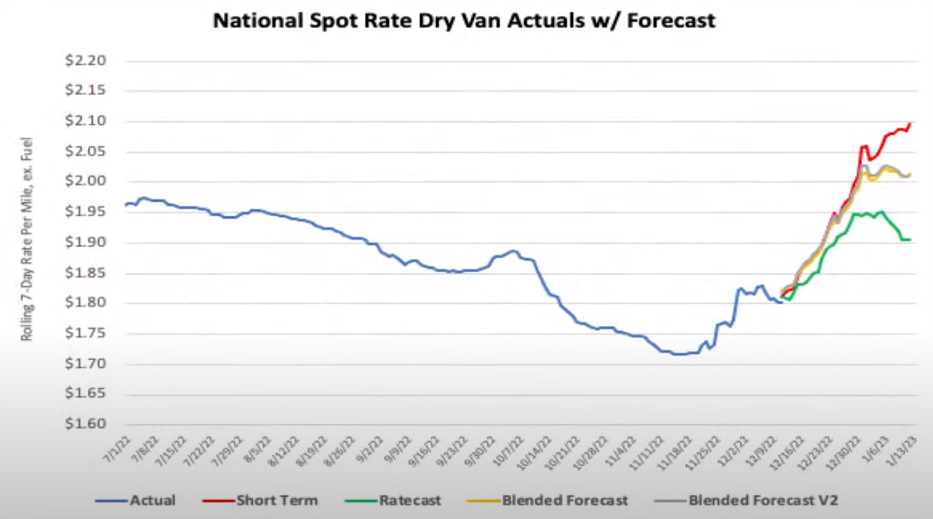

Dry Van

Dry van spot rates saw a slight increase over the past month. This increase is primarily due to Thanksgiving and the rail strike scare. Now that both of those have passed, rates have started to decrease again over the past two weeks. Load post volumes are down about 40% compared to this time last year, while equipment posts are at their highest level in six years. On average dry van spot rates increased $0.04/mile over the last month and are now $0.76/mile lower y/y, about a 35% decrease.

Over the next few weeks, the forecast predicts a substantial increase in dry van linehaul rates going into the holidays. We will then experience a quick decrease back to current levels following the week of New Year’s. Going into January, we expect national dry van linehaul rates to continue to average lower.

The one thing that may stop rates from dropping is fuel prices continuing to fall. Fuel prices and linehaul rates tend to have an inverse relationship. We have seen that as fuel prices increase, linehaul rates decrease. Now, fuel prices may be dropping, which might push linehaul rates up even if demand continues to weaken going into Q1. Due to fuel prices dropping and linehaul rates being as low as they have been, we might see a higher-than-normal holiday spike in linehaul rates.

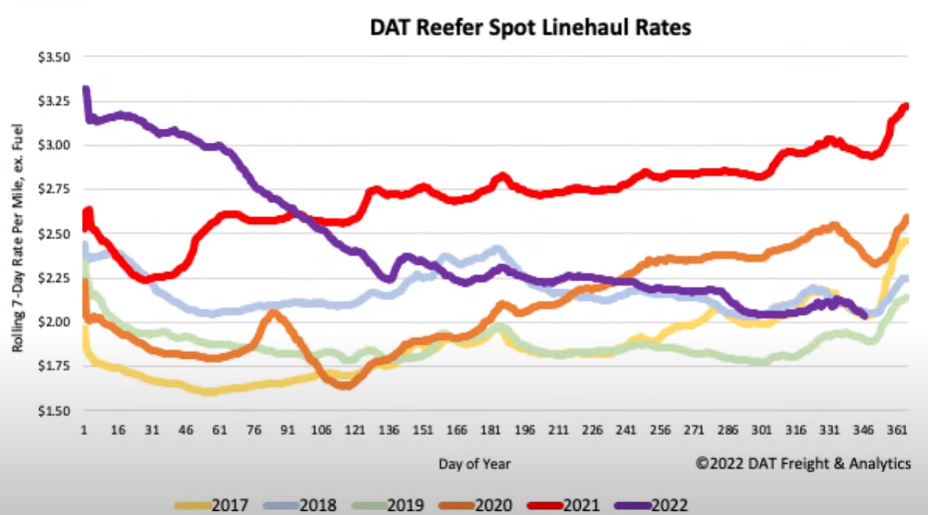

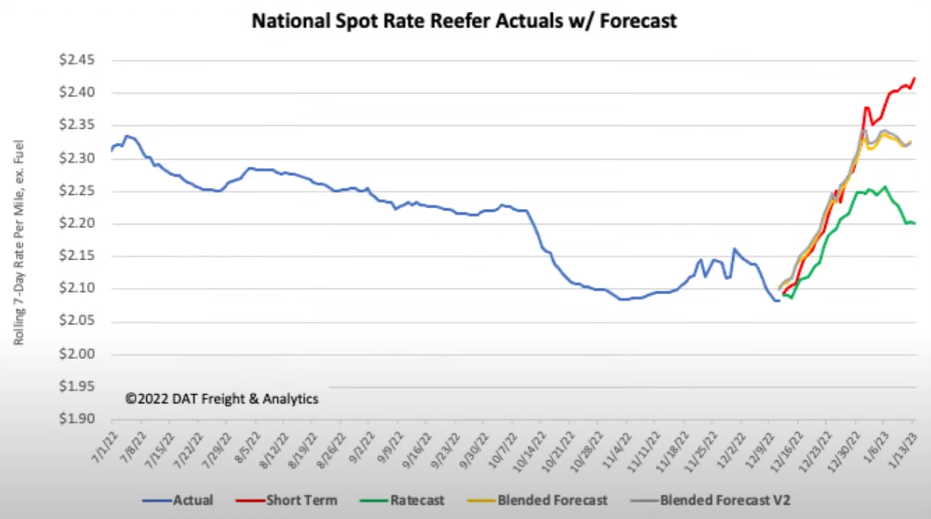

Reefer

Reefer rates continue a downward trend after a slight increase due to seasonal freight and the threat of a rail union strike. Load posts are down 51% compared to this time last year, while carrier equipment postings are at their highest level in six years. Produce volumes are down around 18% compared to this time last year. This is one of the main factors keeping reefer volumes and rates low. On average, reefer spot rates decreased $0.07/mile over the last month and are now $0.91/mile lower y/y, about a 40% decrease.

Similar to van rates, the forecast predicts a strong increase in reefer linehaul rates going into the holidays. We then will experience a sharp decrease back to current levels following the week of New Year’s. Going into January, we expect national reefer linehaul rates to continue averaging lower.

Flatbed

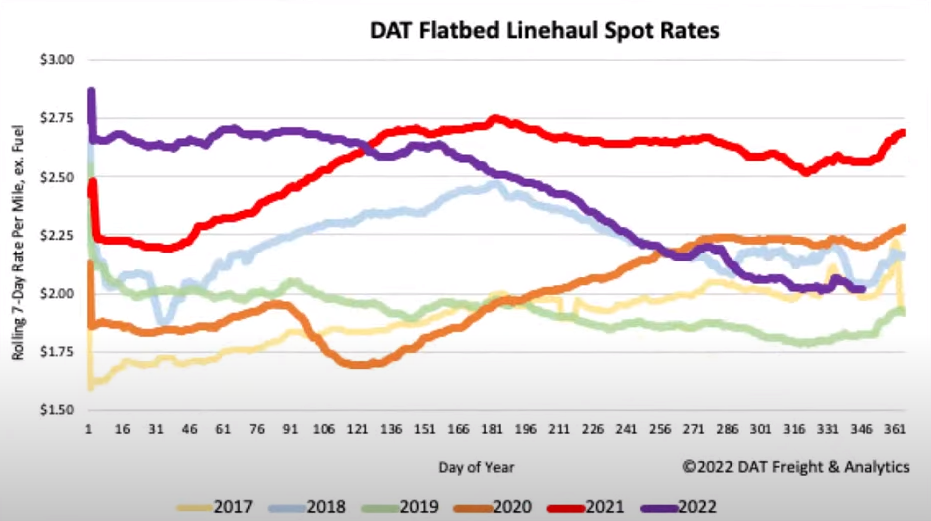

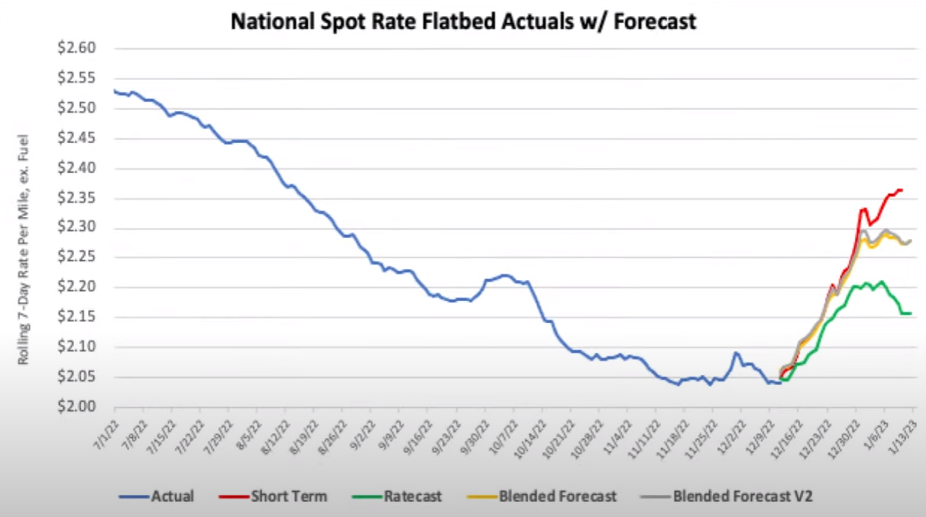

Flatbed spot rates continue a downward trend after a slight increase due to seasonal freight and the threat of a rail union strike. Flatbed load post volumes are still down more than 75 percent. While similar to van and reefer equipment postings, flatbed equipment postings are at their highest level in the past six years. Flatbed linehaul spot rates are down $0.03/mile over the last month and $0.62/mile y/y. Flatbed rates have now dropped around $0.64/mile since June 2022.

Following a path similar to the dry van and reefer linehaul forecasts, flatbed linehauls are predicted to spike over the holiday season and then quickly return to current levels. The main reason for the holiday spike in flatbeds will most likely be caused by equipment exiting the market over that two-week period.

Imports

Import volumes are decreasing quickly across all ports in the U.S., averaging a 9% drop over the month of November. We do expect to see imports continue this downward trend.

Rail

President Joe Biden signed a bill that made it illegal to strike, preventing workers from walking off the job and averting a rail worker strike. Biden and Congress were forced into action when four unions failed to ratify the deal brokered by the union reps and rail lines, primarily to a dispute over paid sick leave. Currently, 70 Democrats in Congress have signed a letter asking President Biden to issue an order giving rail workers the seven sick days a year they were seeking. Currently, there has been no statement from President Biden on this issue.

Fuel

Diesel prices are trending downward over the last month, dropping an average of $0.48/gallon over the previous month. An increase in production and a decrease in demand are starting to allow diesel prices to normalize a bit. While prices continue to drop, it is worth keeping in mind that prices are still $1.105/gallon higher than this time last year. Reserve levels are still lower than usual and will take time to replenish.

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)