Market Insights: At Least One Supply Chain Crisis Averted

This month, we stick to a running theme in American economics: can the Fed lower inflation without nose-diving the economy?

But first, it appears the US has averted a potentially disastrous rail strike. All restrictions are lifted on ingates, and traffic and business can resume as usual.

The agreement reached early Thursday is tentative, pushing it back to the unions for a vote while both parties agree to a "post ratification cooling off period" of several weeks. If the deal is implemented, rail workers stand to earn 24% pay increases over five years from 2020 through 2024, including immediate payouts averaging $11,000 upon ratification. Workers will also receive an extra paid day off, offering better compensation and increased work-life balance.

Meanwhile, stocks plummeted this week following news that US consumer prices rose 0.1% in August, gaining 8.3% from a year earlier. Bankers and investors were caught off guard, anticipating a brighter picture following July's inflation report.

The Fed has some fires to fight. To help cool the inflation jets, they're anticipated to initiate a third straight 75-basis-point interest rate hike, bringing the policy rate range to 3%-3.25%. Higher interest rates make it harder for companies and consumers to borrow money, which raises the risk of a slowing economy.

Read on to see how current events are impacting rates and logistics. We've compiled data from multiple industry sources to bring you the information you need to grow and run your business.

Like what you're reading? Click Subscribe at the top of this post and receive weekly updates straight to your Inbox!

September Notables

- Spot rates continue to slide.

- Contract rates continue their downward trend.

- Imports increase month-over-month with the East Coast remaining strong.

- Hurricane season is nearing its anticipated peak.

Looking to limit transportation disruptions? Connect with Armstrong for access to a network of more than 60,000 vetted, reliable North American carriers.

A Look at Rates

Dry Van

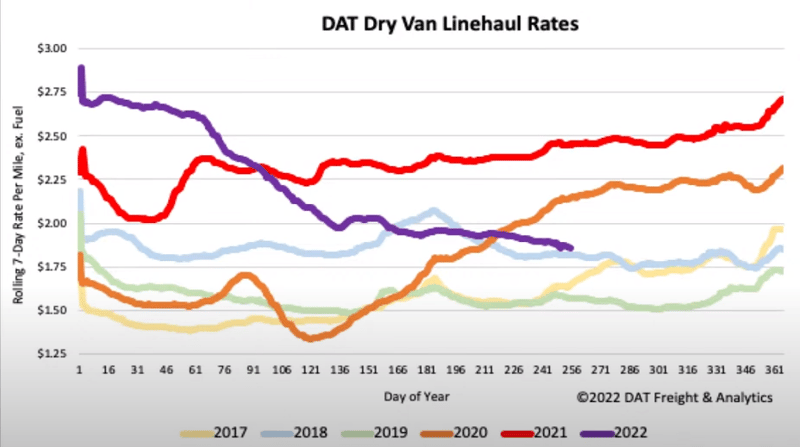

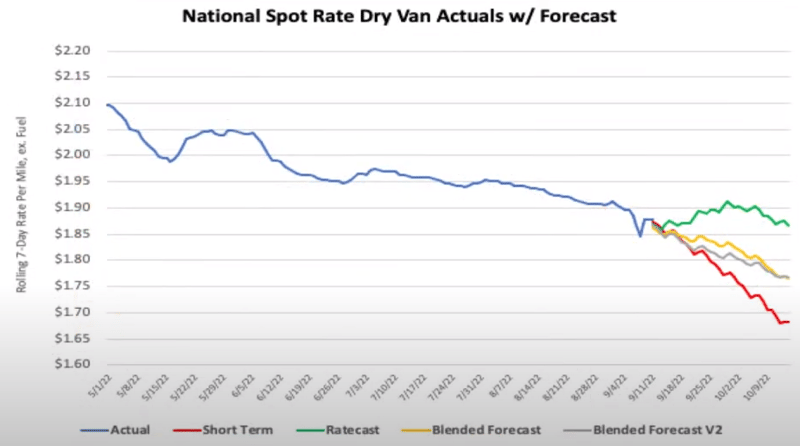

Dry van spot rates have continued their downward trend over the last two months, now down about 32% year-to-date. Only the east and west coast are reporting rate increases. Imports are pushing more freight into the east coast while produce season is beginning in the Pacific Northwest (PNW). Dry van spot rates dropped $0.08/mile over the last month and $0.60/mile lower year over year. Even with the decrease in rates over the previous eight months, dry van spot rates are still around $0.24/mile higher than the average before the pandemic.

Armstrong is seeing a significant divergence in DAT's forecasting model this month. Historically, the dry van market experiences a strong push leading into the holiday season. This year, Armstrong expects capacity to remain loose, preventing rates from increasing. You can expect rates to follow blended forecast models, decreasing slightly over the next month and continuing until the November holidays.

Reefer

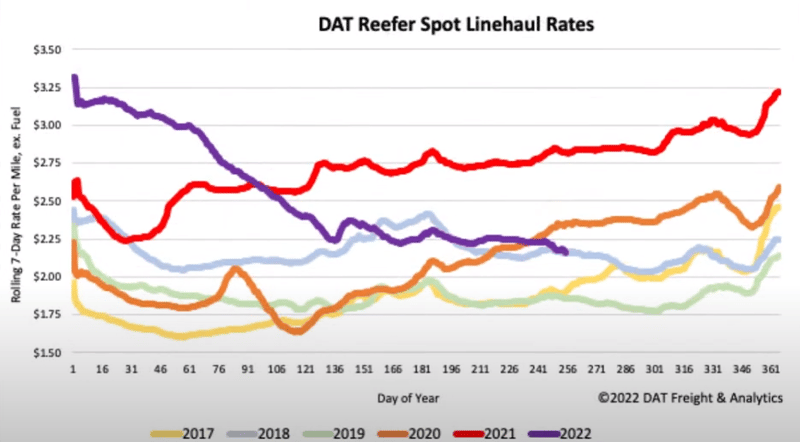

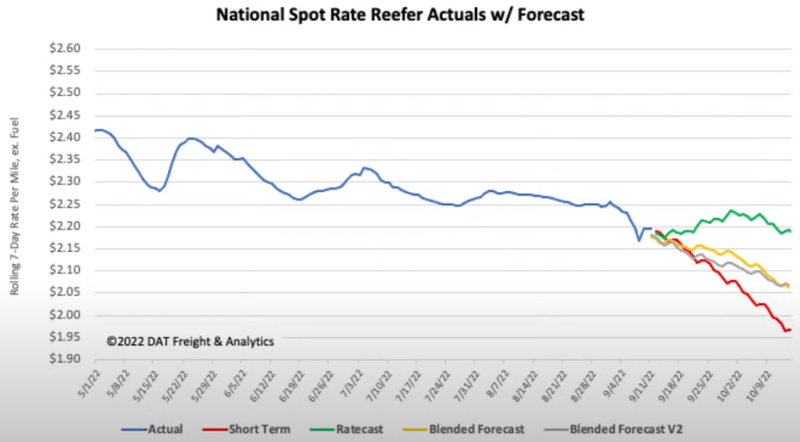

Reefer rates continue their decline after a flat month, now down 31% year-to-date. Equipment postings on load boards are nearly at an all-time high, helping drive a loose capacity market and lower rates. The PNW and Michigan are two of the few areas in the country where reefer rates are rising due to produce seasons ramping up. Average reefer rates out of the PNW are now up around $0.25/mile over the last month and up an average of $0.35/mile out of Michigan. Reefer spot rates dropped $0.09/mile over the previous month and $0.66/mile lower year over year. Even with the decrease in rates over the last eight months, reefer spot rates are still around $0.25/mile higher than the average before the pandemic.

Similar to van rates, DAT's forecast model shows a significant divergence. Armstrong expects reefer rates to follow closely to the blended forecasts, with a slight decrease over the next month (less than shown in the model) and a tick-up in rates around mid-November. The primary exception will be in the PNW, where produce will help continue to increase rates.

Flatbed

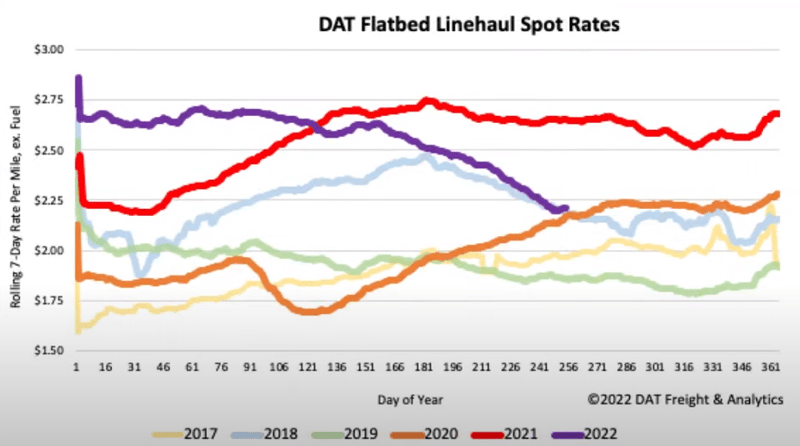

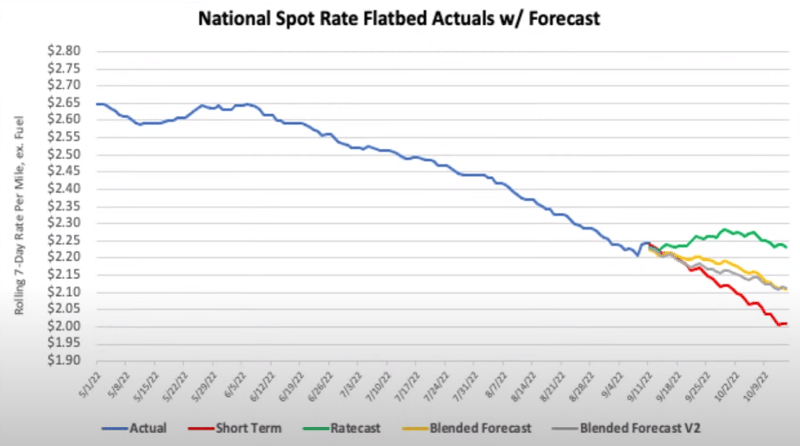

Flatbed spot rates have started to level out after over three months of continuous decreases. Flatbed load post volumes are still down about 50% compared to this time last year and down 12% compared to the previous month. Flatbed linehaul spot rates are down $0.44/mile year over year and $0.28/mile compared to last month.

The DAT model divergence continues to flatbeds. Like van and reefer rates, Armstrong expects flatbed rates to follow closer to the blended forecasts, with a slight decrease over the next month (less than shown in the model). Named weather events could impact rates. While hurricane season started slower than anticipated, with most of the activity occurring in the Pacific, any major storm making landfall will create an increase in demand.

Imports

Import volumes continue to shift away from the West Coast. East Coast volumes are up another 10% month over month, while West Coast volumes are down another 2% month over month. Total volumes are up 4% month over month and continue to look strong into October.

Rail

With nearly 40% of all long-distance trade in the US moved by rail, all eyes remain on the tentative agreements reached by labor unions and rail carriers on Thursday, September 15.

Fuel

Diesel prices have slowed their downward trend over the last few months, down less than $0.10 over the previous month. They are still $1.66 higher than this time last year.

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)