Market Insights: It's the Pandemic That Never Ends

Industry News | Logistics | Transportation | carriers | Freight Management | Shippers | Freight Broker

While Spring Break travel is peaking in the US this month, nearly 400 million people in 45 Chinese cities – about one-third of the population – are under lockdown amid rising Covid cases. It’s the pandemic that never ends.

Industry watchers are concerned that the impact of metropolises, like Shanghai, grinding to a halt has the potential to be worse than at the beginning of the pandemic. Initially, lower export activity in China will give US ports a chance to relieve backlogs, with East Coast entry points currently seeing more volume than West Coast operations. However, since 2020, global trade has become more reliant on exports from China. Any easement in Chinese lockdown restrictions will create a flood of exports, leaving US ports to grapple with an overwhelming movement of goods.Not to be outdone, Texas made headlines after a week of traffic jams and protests at US-Mexico border crossings. What began as an attempt to stop illegal immigration quickly turned into anger-fueled gridlock as Texas state troopers pulled over nearly 1 in 4 trucks for “serious violations that included defective tires and brakes.” It’s estimated that at one point during the crisis, northbound truck shipments fell by 80 percent, creating outrage at a time when supply chain woes and inflation are already impacting daily life. Gov. Greg Abbott signed deals with four Mexican border states to ramp up security, although no human or drug trafficking appeared during the inspections. Guess the cartels were onto that one.

Looking for ways to capitalize on industry trends and grow your business? Read on for more insight into the freight markets!

April Notables

While we’re seeing improved carrier capacity and a general easing in supply chain issues, both volatility and rates remain elevated.

- Van and reefer linehaul rates decreased as fuel continues to increase. Mostly satiated after two years of spending on consumer goods, Americans are once again looking to travel and dining as forms of entertainment. This is the first time linehaul rates are lower year-over-year since Covid began in 2020.

- Due to weather and fertilizer constraints, the 2022 produce season kicking off in the southeast has been slow, down 22 percent year-over-year.

- West Coast ports see fewer containers than the East Coast ports, a direct result of Covid lockdowns in China’s largest port cities.

- Load posts have decreased to 2018 levels as consumer sentiment swings back toward dining and services.

A Closer Look at Freight Rates

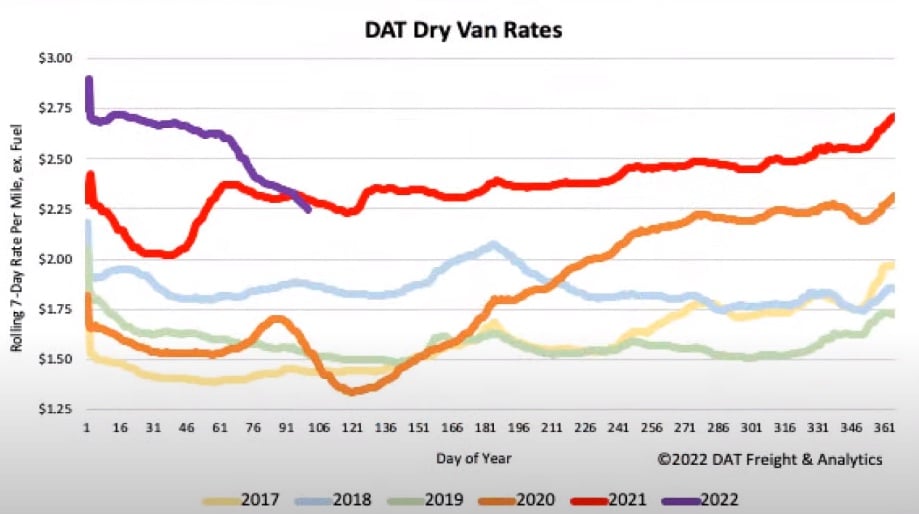

Dry van spot rates have continued their downward trend over the last month, dropping below 2021 levels for the first time.

Rates are currently down $0.06 per mile compared to this time last year, the first time we’ve seen rates drop below the year prior since 2020. Dry van contract rates have plateaued and are now starting to follow the downward trend of spot rates. Contract rates are still about $0.32 per mile higher than spot rates. (Image and data source: DAT)

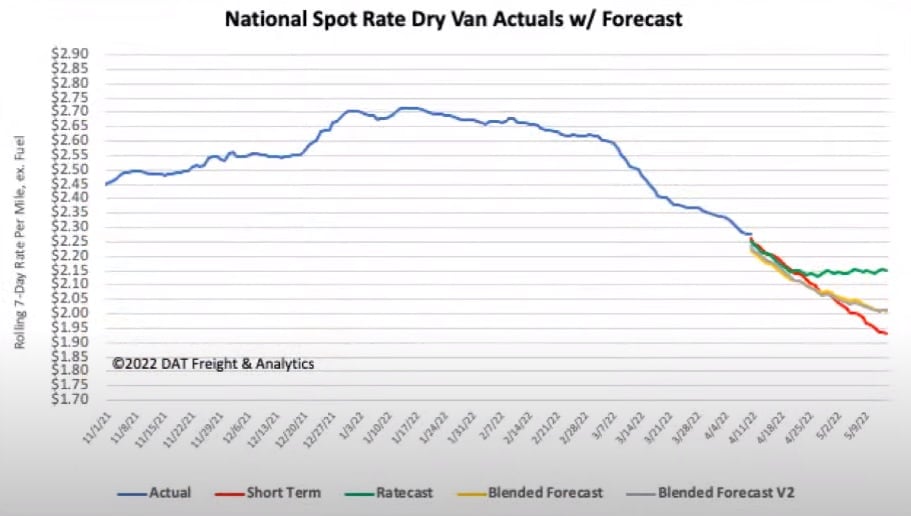

Dry van rates are expected to continue their downward trend over the next month, with this trend likely slowing toward the middle of May. (Image and data source: DAT)

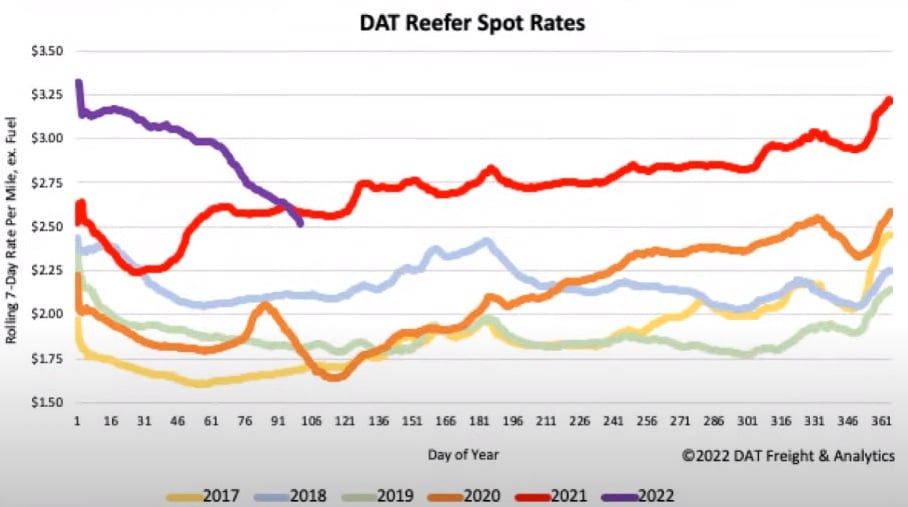

Reefer spot rates have dropped by $0.32 per mile in the last month. Reefer spot rates have also dropped below 2021 levels for the first time. Spot rates are now about $0.05 per mile lower than this time last year. Reefer contract rates have started to decrease for the first time. Slow produce and a loose market are contributing to this late-season decrease. (Image and data source: DAT)

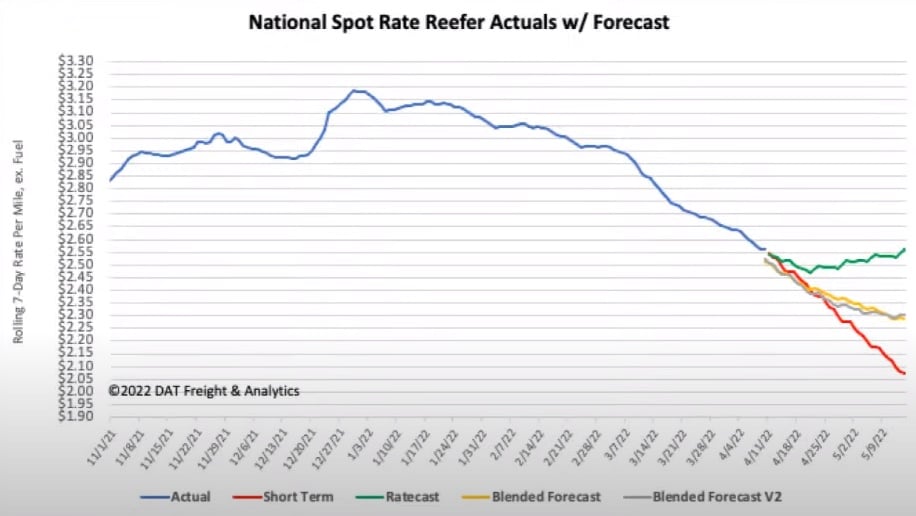

The reefer market is forecasting a slowing decrease in rates as the market enters May. There’s even a good chance that rates will begin to tick upward as we enter the middle of May. This increase is highly dependent on the produce season. Currently, the produce season in the southeast has been very soft due to weather and lower demand. We expect California to see a softer produce season this year compared to last year. (Image and data source: DAT)

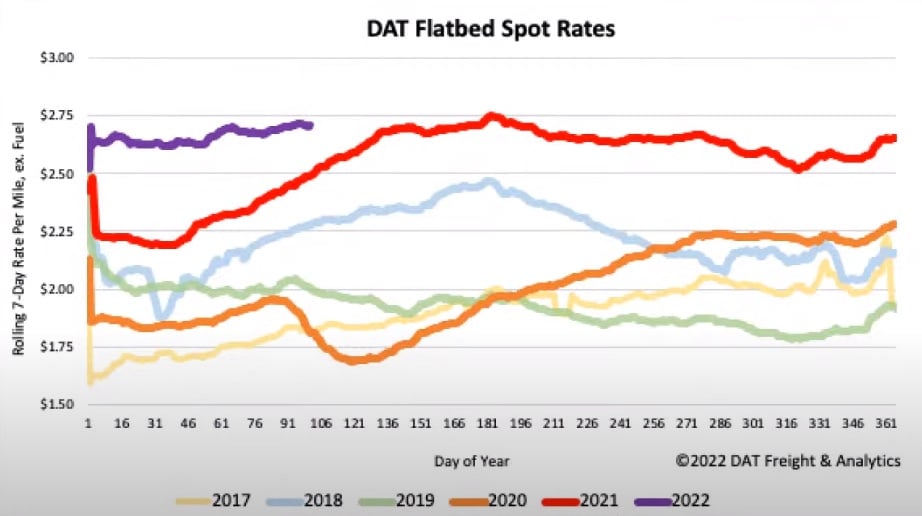

The southeast and Texas are the highest markets right now for flatbed freight, with construction and oil having the most impact. Flatbed spot rates are now only $0.03 per mile lower than the all-time high rates, currently $0.05 per mile year-over-year. (Image and data source: DAT)

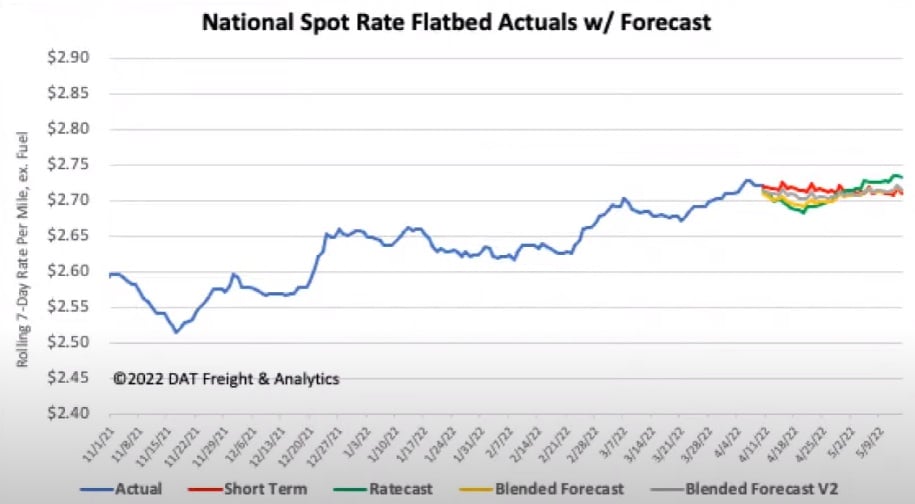

Rates are expected to flatten out over the next month. We predict near-record levels for flatbed rates through the summer. (Image and data source: DAT)

Imports

Inbound volume is now higher on the East Coast than on the West Coast, mainly attributed to Covid-related delays and shutdowns in China. Last month, the Chinese Lunar New Year slowed output in China as workers observed the holiday. That anticipated annual event was followed by an unprecedented shutdown due to a new wave of Covid concerns amid China’s zero-tolerance policy. Until China begins operating at fuller capacity, we expect to see lower import volumes in West Coast ports.

Fuel

Diesel prices have leveled out over the last month with the help of lower global demand and the US releasing the largest ever amount from our reserves. Most economists are expecting prices to remain elevated, but there is a good chance we’ll see slightly more relief at the pumps.

What to Watch

Despite the decreases, rates are still significantly higher than from 2018 to 2020. This means the market still has a lot of room to move, and volatility remains elevated.

This year, the produce seasons saw a later start due to weather and lack of fertilizer; however, the southeast will ramp up production, and rates out of that area will continue to rise as capacity tightens. Southern border markets, which suffered a setback amid US-Mexico border disputes last week, are experiencing tightening capacity. The heaviest impact is in Laredo, TX, McAllen, TX, and Tuscon, AZ.

California’s produce season has begun and will continue ramping up over the next few weeks, heavily impacting reefer rates throughout the Western US.

Spread the Word

Like what you’re reading? Check back with us monthly to stay up to speed on freight market conditions. Our snapshots compile market data from reputable public sources to help you stay informed.

Do you know someone in the industry who could benefit from a snapshot and analysis of the market today? Share this post or comment below - we welcome feedback from our community!

Subscribe to our blog today and get these updates in your inbox.

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)